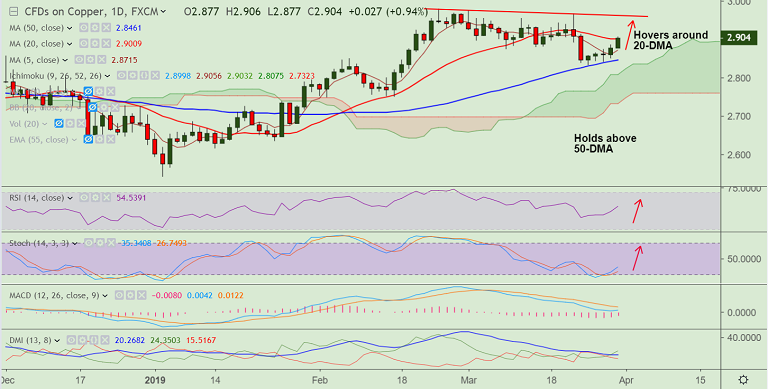

Copper chart - Trading View

- Copper is extending gains for the 5th straight session, bias bullish.

- Hopes of progress in U.S.-China trade talks and low inventories keeps prices supported.

- Stockpiles of copper in LME-registered warehouses, slipping back towards 11-year lows below 120,000 tonnes hit earlier this month.

- Technical indicators are also turning bullish. RSI and Stochs are showing a turn.

- Price action has bounced off 50-DMA support and has broken above 5-DMA.

- Decisive close above 20-DMA will see further upside. Test of 2.960 (trendline) then likely.

- On the flipside, 5-DMA is immediate support at 2.8723. Break below 50-DMA to see further downside.

Support levels - 2.8723 (5-DMA), 2.8462 (50-DMA), 2.8075 (cloud top)

Resistance levels - 2.960 (trendline), 2.979 (Feb 25 high)

Recommendation: Stay long on close above 20-DMA, SL: 0.8720, TP: 2.960

For details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.