It seems that nothing can stop CNY and KRW, at least for now. KRW strengthened by another 0.2% versus USD this morning.

The rate hike expectation in South Korea has triggered the recent sell-off in USDKRW.

Some sort of dollar strength arisen lately but that was part of a broader turnaround in USD sentiment rather than anything KRW specific. Geopolitical issues have not ratcheted higher over this period but at the same time, the market remains wary that this could change quite quickly. This, in turn, leaves the market reluctant to chase USD/KRW lower.

As KRW accounts for 10% of China’s official CNY index, a rapid appreciation of KRW will translate into a lower USD-CNY exchange rate as the PBoC intends to stabilize the CNY-index.

However, even after past strong sessions, the CNY index has actually eased somewhat. In other words, if CNY fully tracks the KRW’s performance, USDCNY still has room to trend lower.

The G3 capex theme is a positive, as is the strength in China’s new economy (with the technology sector expanding strongly over the past 12 months). Korea is well placed to benefit from a continuation of these trends.

In fact, the Korean authorities think that KRW’s recent appreciation is overdone, warning that it will take actions to crack down the “excessive” activities.

However, it seems that nobody takes this seriously as traditionally the Bank of Korea is not an active player in the FX market. At the end of the day, the market cares about what you did, not what you said.

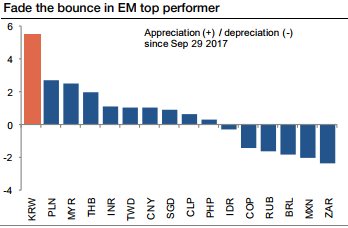

Risk-reward favors long dollar exposure from a short-term (1-2m) trading perspective. Large move relative to history and EM peers: The 5% KRW appreciation in the past two months represents a two-standard-deviation move (over a 2m period) since 2012 and the performance gap versus EM peers is very high.

Reversal after a large appreciation: In four episodes since 2012 when USDKRW has fallen by a similar magnitude as currently, the cross has subsequently corrected higher in three instances. Also, the BoK has been passive for most the year but could become more active in limiting downside given the speed of appreciation and peer outperformance.

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts