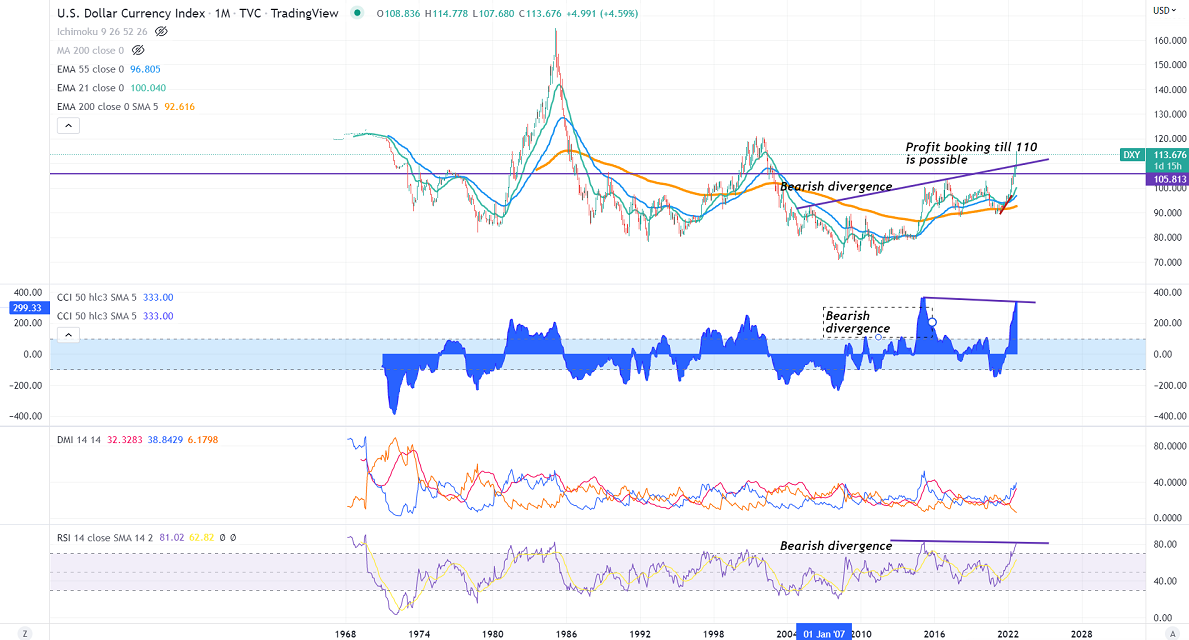

Major support- 113

Major resistance- 115

RSI in Monthly chart-

US dollar index- 81.49 (Overbought)

Bearish divergence in the monthly chart (CCI- 50) (positive for gold).

DXY trading higher for the past 11 years and surged more than 60% from a low of 70.69 (Mar 2008 low). The index performed well in the past two quarters due to the hawkish rate hike by Fed. The central bank hiked rates by 225 bpbs total in the past three meetings and planning to increase rates further to tackle inflation. According to the CME Fed watch tool, the probability of a 75 bpbs rate hike in Nov dropped to 58% from 70.1% a week ago.

On the lower side, near-term support is around 113 (23.6% fib) and violation below will drag the index down to 112.35/110.75/110. Significant resistance is around 113.80, and breach above targets 114.55/115/116.

It is good to sell on rallies around 114 with SL around 115 for TP of 110.80.