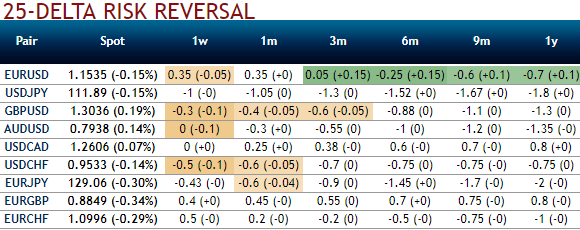

Please be noted that the nutshell above showing IVs skews and risk reversals of EURJPY have been indicating mounting bearish risks in both short and long run.

On the contrary, technically, the current prices of this pair are still well above 21EMAs. On a broader perspective, bull swings are hovering at 50% Fibonacci levels in the consolidation phase from last one year or so.

We reckon EURJPY IVs are considerably on higher levels among G10 OTC FX space that pops up with rising IVs shy above 9.5% for 3-month tenors (highest among the G10 FX space) having significance in economic drivers that propels this currency pair to anywhere.

We think the same HY IVs with longer tenors are conducive and justifiable for option holders as there are series of considerable economic events lined up going forward.

Well, in order to arrest the bearish risk that is lingering in intermediate trend and long term uptrend in the consolidation phase, we recommend diagonal option strip that favors underlying spot’s upside bias in short run and mitigates bearish risks in long term.

So, we recommend building the FX portfolio exposed to this pair with longs positions in 2 lots of 3M ATM -0.49 delta puts and 1 lot of ATM 0.51 delta calls of 1m expiries.

Since the spikes are likely in near term and downswings in longer term seem to be dubious as per the signals generated by risk reversals as well as from IV skews, EURJPY option straps strategy should take care of both upswings and downswings simultaneously. The strategy is likely to derive handsome returns on the downside and certain yields regardless of swings on either side but with more potential on the downside.

Datawise, BoJ yesterday has not surprised by staying pat in its monetary policy, while ECB today has been the center of attention.

European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data