Technically, more downside traction is foreseen in the weeks to come as the current prices have broken below strong supports at 72.998 levels and on monthly charts slid well below EMAs with leading oscillators to signal selling momentum.

We saw NZ GDT price index that measures the change in the average price of dairy products sold at auction, has reduced from previous 0.0% to the current -0.4%. It has been a leading indicator of Kiwis trade balance with other countries because rising commodity prices boost export income as NZ contributes maximum through this source to their GDP.

While, we have flurry data announcements in Japan, namely, current account balance for tomorrow.

Upper house elections are slated during this weekend. Preliminary and core machinery orders, PPI, and industrial production are scheduled for the next week.

Currency Option Strategy: NZD/JPY Short Put Ladder

Rationale: Unlimited downside, limited upside profit potential and higher IVs favor option holders.

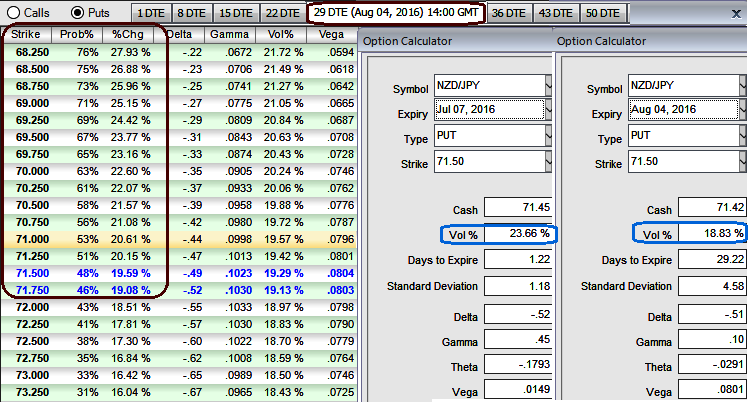

The current ATM IVs are trending higher at 23.66% which means the market thinks the price has potential for large movement in either direction, but you can observe the %change in premiums as the put contracts drifts into in the money (there exists the crux of derivative contracts). We think higher IVs are flashing mainly due to the above data events.

How to execute: Short 3D (0.5%) ITM put option and simultaneously add longs on 2W ATM -0.49 delta put option and one more 1M (1%) OTM -0.36 delta put option.

Maximum returns are limited to the extent of initial credit received if the NZDJPY rallies above the upper breakeven point (BEP) but large unlimited profit can be achieved should the underlying exchange rate of NZDJPY makes vivid downswings below the lower BEP.

Since the short put ladder is an unrestricted return with partial risk bearing strategy that is deployed because in addition to any abrupt upswings in the short term and robust downtrend in long-term. We think that the NZDJPY would likely significant volatility in the near term.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings