The Bank of Canada’s (BoC) rate decision today is unlikely to get anyone excited. The key rate is likely to remain unchanged at 0.25%, as there is increasing evidence that for now the worst is over for Canada as far as the corona pandemic is concerned. Friday’s labour market data surprised with a much more pronounced rise in jobs than expected.

On the other hand, the corona crisis has not yet been overcome, there is the risk of a second wave, and in some countries the virus is still spreading quickly – as is the case in the neighbouring US.

So, the market is likely to be keeping a close eye on the outlook that will be published by the BoC as part of its monetary policy report. Focus will also be on the press conference as it will be the first one under the new BoC governor Tiff Macklem. Everything all told today’s meeting is unlikely to move CAD much. The BoC is unlikely to promise that key rates will rise again in the foreseeable future. The most that could happen is that speculation about negative interest rates might get a dampener. The BoC could also promise that it will further reduce the extent of its quantitative easing measures. That might provide support for CAD short-term. However, the meeting is unlikely to provide long term momentum.

USDCAD OTC Outlook And Options Strategy:

Given the above concerns, despite the struggling momentum in USDCAD in the recent past, we maintain that directionality from here is higher in the pair. It makes sense that CAD has focus on Canada's specific weaknesses grows larger.

Hence, add longs in USDCAD via options with diagonal tenors contemplating above fundamental factors and below OTC indications:

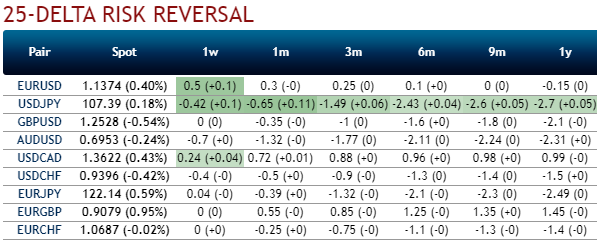

The fresh positive bids to the existing bullish risk reversal setup indicates the broader hedging sentiments for the upside price risks amid minor hiccups in the shorter tenors (refer 1st chart).

To substantiate this stance, we combine the positively skewed IVs of 3m tenors that are indicating the upside risks in the days to come (refer 2nd chart).

Hence, at this juncture (spot reference: 1.3562 levels), we activate shorts in CAD on hedging grounds via 3m/2w (1.3315/1.39) debit call spread. If the scenario outlined above unfolds, we will re-assess our stance but at the moment there are no changes to our CAD recommendations. Courtesy: Sentry, Saxo & JPM

China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise