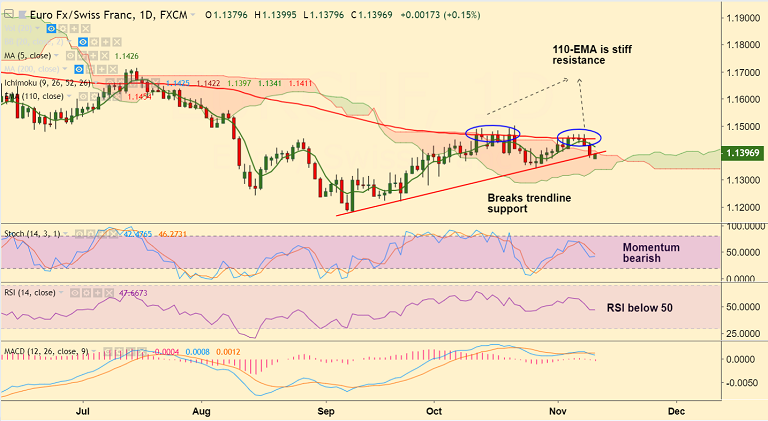

EUR/CHF chart on Trading View used for analysis

- EUR/CHF closes bearish gap open to trade at 1.1389 at the time of writing.

- The pair has slipped below major moving averages and dipped into daily cloud.

- Momentum studies are bearish and RSI is below 50 levels. We see scope for further weakness.

- Italy budget deadline looms Tuesday, where it is required to submit a revised budget draft to the EU.

- Italy-German yield spread looks set to rise in the EUR-negative manner as Italy is unlikely to revise lower its expansive budget deficit target.

- EUR/CHF rejected at stiff resistance at 110-EMA, breaks strong trendline support at 1.1390, eyes 1.1342 (cloud base and Oct 26 low).

Support levels - 1.1342 (cloud base and Oct 26 low), 1.13, 1.1281 (Sept 28 low)

Resistance levels - 1.14, 1.1424 (5-DMA), 1.1453 (110-EMA)

Recommendation: Stay short on upticks, SL: 1.1425, TP: 1.1340/ 1.13/ 1.1285

For details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?