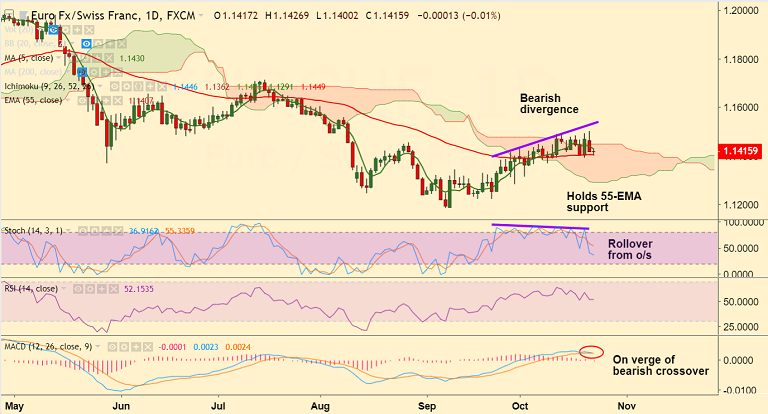

EUR/CHF chart on Trading View used for analysis

- EUR/CHF trades in tight ranges on the day, with session high at 1.1414 and low at 1.1392.

- The pair remains largely muted at 1.14 handle despite upbeat EMU CPI data.

- Data released earlier today showed headline consumer prices are expected to rise at an annualized 2.2% in October.

- While Core prices are seen gaining 1.1% over the last twelve months, both prints coming in above expectations.

- Technical indocators are neutral to slightly bullish. Breakout of cloud likely to see further upside.

- On the flipside, we see weakness below 5-DMA at 1.1387. Dip till lower Bollinger Band at 1.1352 likely.

Support levels - 1.1387 (5-DMA), 1.1352 (lower BB)

Resistance levels - 1.1416 (20-DMA), 1.1457 (110-EMA)

For details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics