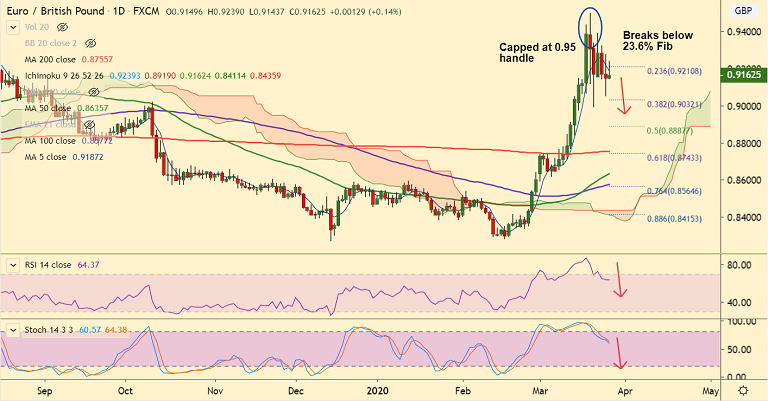

EUR/GBP chart - Trading View

EUR/GBP edges lower from session highs at 0.9239, gradual decline seen as pair eases from overbought levels.

Market focus on the Bank of England (BoE) monetary policy update. The BoE is expected to leave its policy unchanged after two emergency moves.

The central bank slashed rates to 0.25% in the previous week, after which, the bank's lending rate stands at 0.10%.

Its Quantitative Easing program stands at £645 billion – up £200 billion from the previous levels.

The BOE also announced a lending scheme worth around £100 billion, in its first coronavirus emergency decision.

Technicals suggest EUR/GBP is set to extend weakness. 5-DMA is sharply lower and Stochs and RSI have rolled over from overbought levels.

'Death Cross' (bearish 50-DMA crossover on 200-DMA) confirmation on the hourly charts adds to the bearish bias.

Support levels - 0.9032 (38.2% Fib), 0.8967 (21-EMA)

Resistance levels - 0.9185 (5-DMA), 0.9210 (23.6% Fib)

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation