In this month, we will see several developments including notably the UK Brexit vote and the June FOMC meeting that could propel volatility factor in FX markets both including spot and OTC markets.

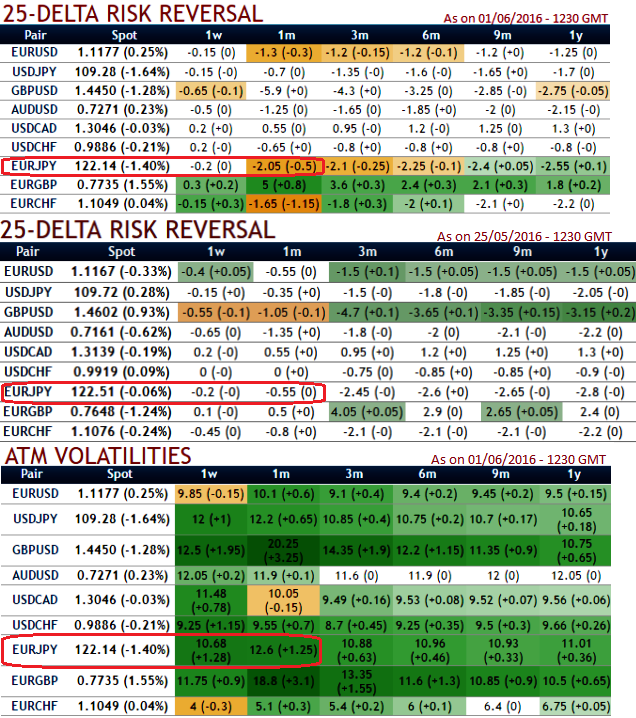

We could see that in nutshell showing IVs and delta risks reversals, while, the EUR/JPY 2m risk reversal is trading at extreme historical highs in favour of yen calls, close to the peak at -2.5 vols and within this tenor risk reversal strategy encompasses above stated risky events.

Thus, buy EUR/JPY 2m put backspread 2:1 with OTM shorts of 2w expiries, strikes 122.887/119, this strategy is short volatility, which is attractive as the 2m implied vol is trading one volatility point above the realised volatility (positive risk premium).

The competitive advantage is that the positive theta makes it a natural buy-and-hold strategy, as the structure pays off its maximal leverage if the spot trades close to the 119 strike only near the expiry.

The profile is however selling convexity, such that a very fast downside move would deteriorate the mark to market.

In that event, investors may have to dynamically manage the delta to avoid losses.

On data front, we continue to maintain our bearish stances in this pair as the ongoing downtrend to prevail further ahead of ECB's monetary policy decision, OPEC meet, Spanish employment change for today, and service PMIs of Western Europe countries for tomorrow.

Japan produced healthy trade balance numbers in last month, Japan recorded a 823.47 JPY billion surplus in April of 2016, and continued to produce good set of retail sales (-0.8% beat expectations -1.2%), upbeat industrial productions (0.3% versus forecasts at -1.4%), upbeat consumer spending numbers (40.9 versus forecasts at 40.4) and Japanese unemployment claims remain unchanged at 3.2%.

The options market is pricing that yen appreciation will be more volatile than a yen fall.

This does not necessarily mean that the spot will move significantly but rather that downside price action is expected to be more erratic.