EUR/JPY chart - Trading View

EUR/JPY sidelined, was trading in a narrow range ahead of the crucial eurozone Q2 GDP data.

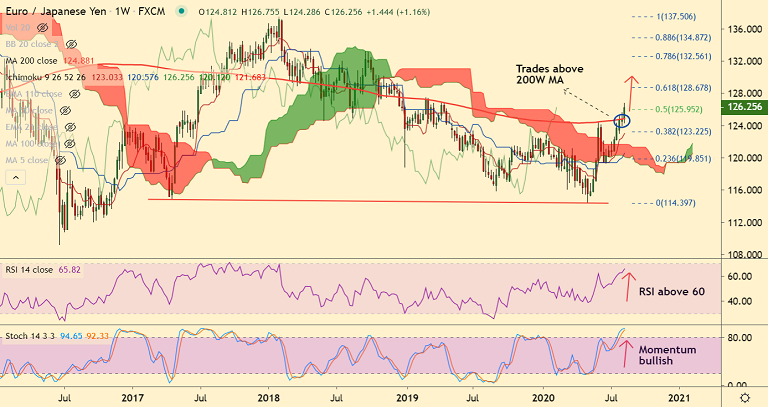

The pair has been on an upward spiral since May and price action has broken major 200W MA resistance raising scope for further gains.

Technical indicators are bullishly aligned. Stochs and RSI are sharply higher. GMMA indicator shows major and minor trend are sharply bullish.

The single currency, however, may come under pressure, if the Eurozone GDP shows a bigger-than-expected economic contraction in Q2.

Pullbacks maybe limited on account of bullish indicators. Break below 200H MA could see significant weakness.

Major Support Levels: 125.58 (5-DMA), 125.22 (200H MA), 124.88 (200W MA),

Major Resistance Levels: 127.50 (Feb 2019 high), 128, 128.67 (61.8% Fib)

Summary: Focus on eurozone GDP data. A bigger-than-expected economic contraction could see some weakness. The pair trades with a strong bullish momentum. Weekly close above 200W MA will propel the pair higher. Next bull target lies at 61.8% Fib at 128.67.