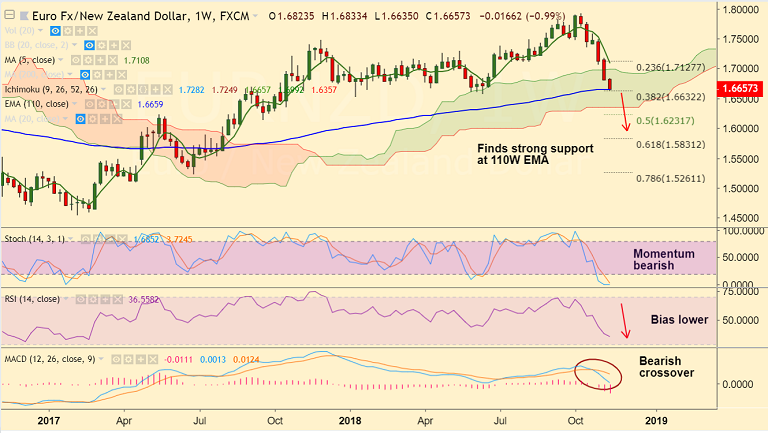

EUR/NZD chart on Trading View used for analysis

- EUR/NZD is extending weakness for the 3rd straight week. Focus on German and EZ GDP data.

- The pair has paused downside at strong support at 110W EMA at 1.6659. Break below will see further weakness.

- German economy is likely to have contracted 0.1% q/q in Q3, following a 0.5 percent expansion in the previous quarter. An above-forecast reading may put a bid under the EUR.

- That said, Italy-EU standoff continues to weigh on the single currency and hence upside could be short-lived.

- Technical studies are supportive for further downside in the pair.

- Break below 110W EMA could see drag till weekly cloud base at 1.6357 ahead of 50% Fib at 1.6231.

- On the upside, break above 1H 55-EMA at 1.6716 could see some upside. Test on 1H 110-EMA at 1.6786 likely.

Support levels - 1.6659 (110W EMA), 1.6357 (weekly cloud base), 1.6231 (50% Fib)

Resistance levels - 1.6716 (1H 55 EMA), 1.6740 (5-DMA), 1.6786 (1H 110 EMA)

Recommendation: Watchout for break below 110W EMA to go short, target 1.6360/ 1.6230

For details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge