- EUR/NZD edges higher from session lows at 1.7355, finds support at 5-DMA at 1.7352.

- The single currency ticked higher after upbeat German Ifo Business climate data.

- Headline German business climate index rose to 103.8 in August beating consensus estimates for an uptick to 101.9.

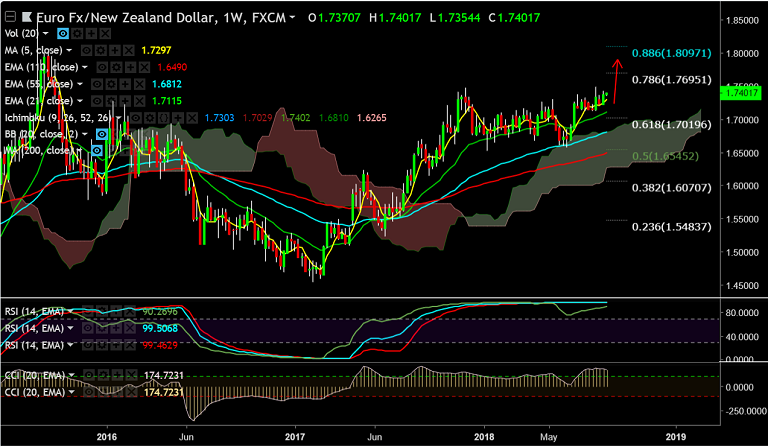

- Momentum studies are bullish, Stochs and RSI are biased higher. RSI shows strength at 62 levels.

- MACD is above zero levels and price action above daily cloud and major moving averages.

- We see strong trendline resistance at 1.7470. Breakout there could see test of 78.6% Fib at 1.7695.

Support levels - 1.7352 (5-DMA), 1.7298 (5W SMA), 1.7281 (21-EMA)

Resistance levels - 1.7470 (strong trendline resistance), 1.7480 (Nov 2017 high), 1.7695 (78.6% Fib)

Recommendation: Good to go long on break above major trendline resistance at 1.7470, SL: 1.7280, TP: 1.76/ 1.7695

FxWirePro Currency Strength Index: FxWirePro's Hourly EUR Spot Index was at 126.224 (Bullish), while Hourly NZD Spot Index was at -96.9143 (Bearish) at 1000 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.