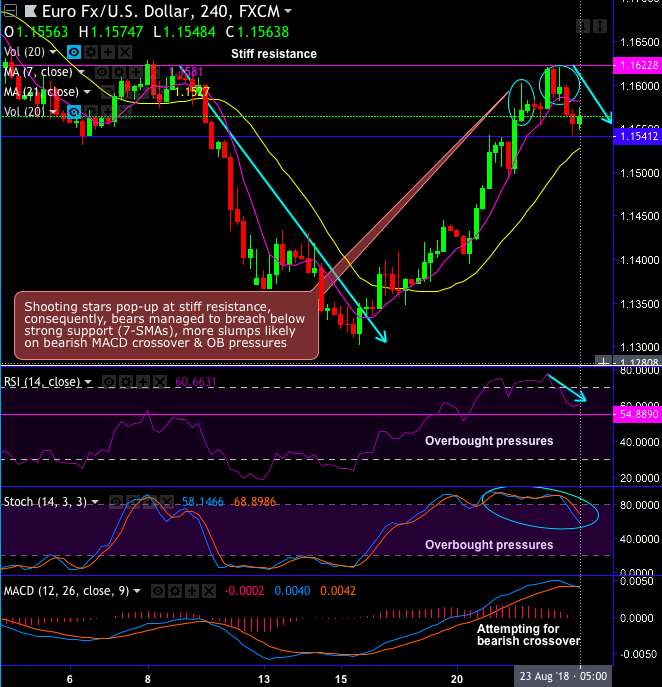

EURUSD forms shooting stars and hanging man patterns at 1.5705, 1.1573 and 1.1596 levels, consequently, price plunged below 7-SMAs.

As per our long-term analysis, the major trend has been sliding through sloping channel (refer monthly chart), where the shooting star pattern pops-up at channel resistance, ever since then you could make out steep slumps below EMA levels and retraced more than 50% Fibonacci levels of January 2018 highs (i.e. 1.2612) and January 2017 lows (i.e. 1.0371 levels).

You could easily observe, as and when such patterns pop up at the stiff resistance levels, failure swings have taken the downtrend upto channel support.

The current price slides well below 21-EMA as both leading oscillators signal bearish momentum, bears are likely to extend 1-year lows for now, and likely to retrace 61.8% Fibonacci levels from 2018 highs.

We also highlight 1.0340 as a major low, which bottomed-out the cycle from the 1.60 highs in 2008. We foresee the current medium-term pullback as corrective and expect a broader range to develop. Ultimately, the charts signal an eventual move back towards 1.30-1.35 and then 1.45-1.50 levels.

Overall, for now, more slumps seem to be on cards upon bearish MACD crossover and intensified bearish momentum.

At spot reference: 1.1553 levels, capitalizing on prevailing bearish momentum, one can bid upper strikes at 1.1569 and short lower strikes at 1.1523 (at around 21DMA levels) to construct tunnel options spread, the strategy is likely to derive exponential yields as long as the underlying spot keeps dipping but remains well above lower strikes on expiration.

On hedging grounds, initiate shorts in futures contracts of mid-month tenors with a view to arresting bearish risks.

Currency Strength Index: FxWirePro's hourly EUR spot index is inching towards 50 levels (which is bullish), while hourly USD spot index was at -48 (bearish) while articulating (at 09:16 GMT). For more details on the index, please refer below weblink: