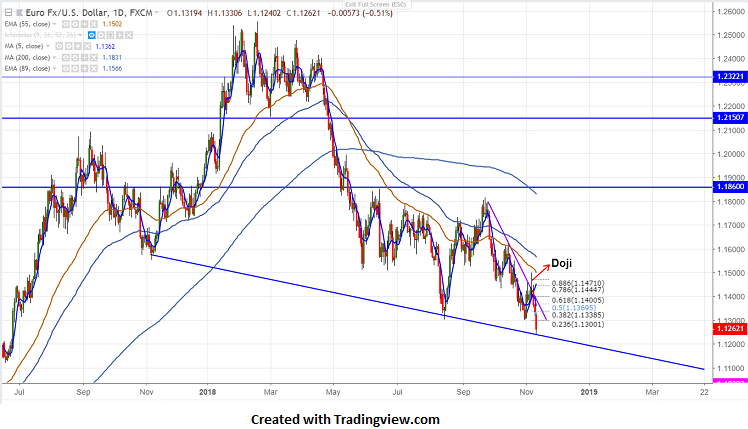

EURUSD has broken major support of 1.1300 after a long consolidation. The pair hits intraday low of 1.12400 for the day. The major reason for the slump in Euro was policy divergence between US Fed and ECB , Italian budget deficit problem and widening of spread between Italy 10 year and German bund. It is currently trading around 1.12550.

On the lower side, near term trend line support is around 1.12400 and any break below targets 1.1200/1.1150 level.

The major trend reversal only above 1.15000 and any violation above targets 1.16200. Major bullishness only above that level. The near term resistance is around 1.13000 (23.6% fib) and any break above targets 1.13600 (5- day MA)/1.1400.

It is good to sell on rallies around 1.13000 with SL around 1.13600 for the TP of 1.11600.