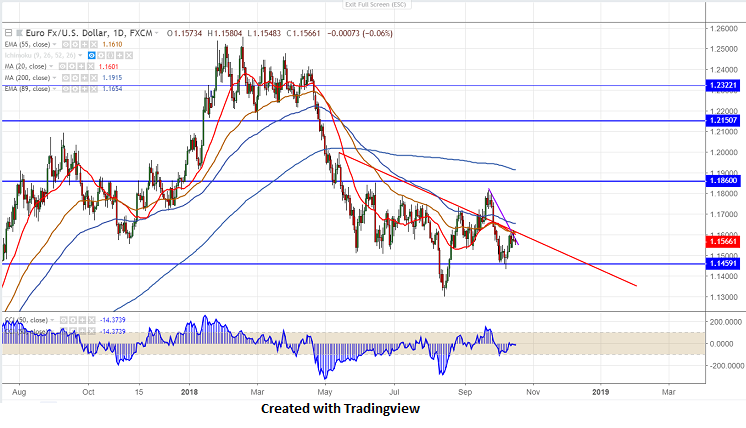

EUR/USD has pared most of its gains made yesterday. It hits high of 1.1622 and started to decline from that level. The pair declined till 1.15483 and is currently around 1.15652. Markets await US fed minutes meeting for further direction. On the data front, German ZEW sentiment came weaker than expected. US Building permits and housing data to be released today will have minor reaction.

On the higher side, near term strong resistance is around 1.1620 (20- day MA) and any break above targets 1.1660/1.1720.The pair should break above 1.1800 for further bullishness continuation.

The near term minor support is around 1.1500 and any violation below targets 1.1460/1.1430. Any convincing break below 1.1430 confirms major bearishness.

It is good to sell on rallies around 1.1600 with SL around 1.1660 for the TP of 1.1500.