EURUSD is gaining strength ahead of US President Trump and Xi meeting. The pair recovered more than 30 pips from yesterday’s low of 1.12673.The US dollar is still under pressure after dovish statement from Powell. The pair hits high of 1.14017 and is currently trading around 1.13880.

The Italian 10 year bond yield is trading lower and spread between German and Italy 10 yield is around 292 basis point compared to 330 bpbs.

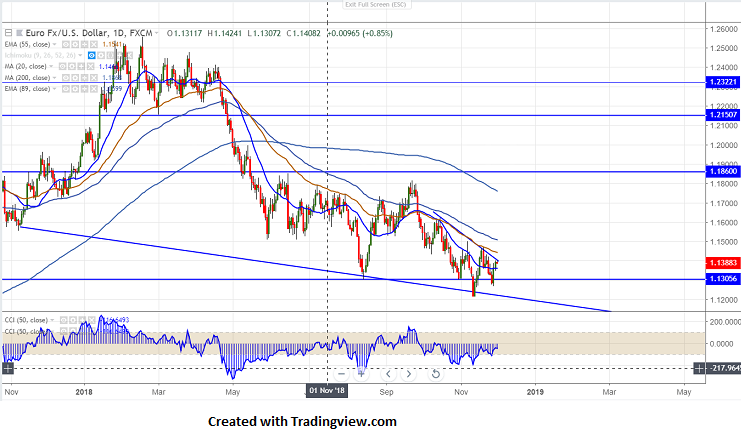

On the higher side, 1.1435 will be acting as near term support and any break above targets 1.14750/1.1500. The pair should break above 1.1500 for further bullishness.

The near term support is around 1.13600 and any break below targets 1.1300/1.12690. Major support is around 1.32160 level.

It is good to sell on rallied around 1.1425-30 with SL around 1.1475 for the TP of 1.1300/1.12690.