GBPAUD forms back-to-back bearish patterns at 1.7817 and 1.7822 levels, consequently, bears managed to plummet prices below EMA (refer weekly chart).

While the consolidation phase in the intermediate trend seems exhausted at rising channel resistance as the shooting stars pop up at the juncture as well to signal weakness, as a result, we saw steep slumps. But dragonfly doji has occurred at 1.7646 levels to bounce back. But for now, above-stated bearish patterns have countered back coupled with both leading and lagging indicators signalling downward convergence to the prevailing price dips.

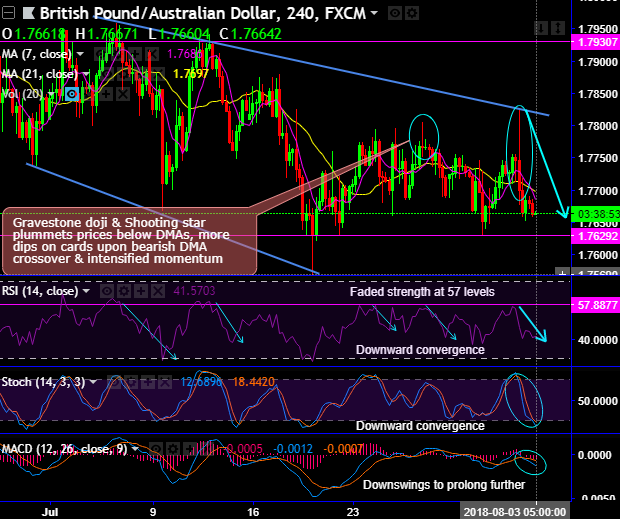

On 4H charts, the intraday trend has been sliding through sloping channel, sharp shooting star patterns pop-up at 1.7664 levels and gravestone doji at 1.7765 levels.

Consequently, the bears are capitalizing on this timeframe as well to evidence considerable price dips below 7SMAs, next strong support is seen at 1.7629 levels.

For now, more dips on cards in short run at least upon bearish DMA crossover and intensified selling momentum. While in medium-terms, expect more slumps on a decisive breach below this range.

Momentum study: The stochastic oscillator has been popping up with selling pressures with its %d crossover which is a bearish indication, in addition to that, RSI has also been converging downwards to the prevailing price dips right from the overbought zone (see weekly) and signals strength in its bearish sentiments.

Trading tips:

Well, contemplating above technical reasoning, on speculative grounds we advise one touch put options favouring bearish indications. This option strategy is likely to fetch leveraged yields than spot FX if the IV of this option keeps rising and underlying spot keeps dipping.

Currency Strength Index: FxWirePro's hourly GBP spot index is flashing -92 (which is mildly bearish), while hourly AUD spot index was at shy above 16 (neutral) at 05:42 GMT. For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex

The above indices are also conducive to the trade recommendation.