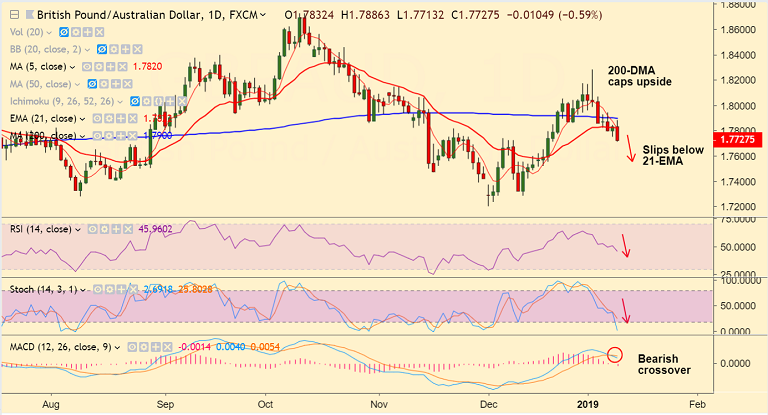

GBP/AUD chart on Trading View used for analysis

- GBP/AUD trades 0.58% lower on the day at 1.7728 at 1200 GMT.

- The pair has been rejected at 200-DMA and has broken below 21-EMA support.

- Momentum studies are bearish. Stochs and RSI are sharply lower.

- MACD is showing a bearish crossover on signal line which adds to the bearish bias.

- Next major support lies at 61.8% Fib at 1.7620 ahead of major trendline support at 1.75.

- On the flipside, strong resistance is seen at 1.7820 (nearly converged 5-DMA and 21-EMA).

- Bearish invalidation only on break above 200-DMA

Support levels - 1.7620 (61.8% Fib), 1.76, 1.75 (trendline)

Resistance levels - 1.7820 (nearly converged 5-DMA and 21-EMA), 1.79 (200-DMA)

Recommendation: Good to go short on upticks around 1.7740/50, SL: 1.7825, TP: 1.7620/ 1.75

For details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.