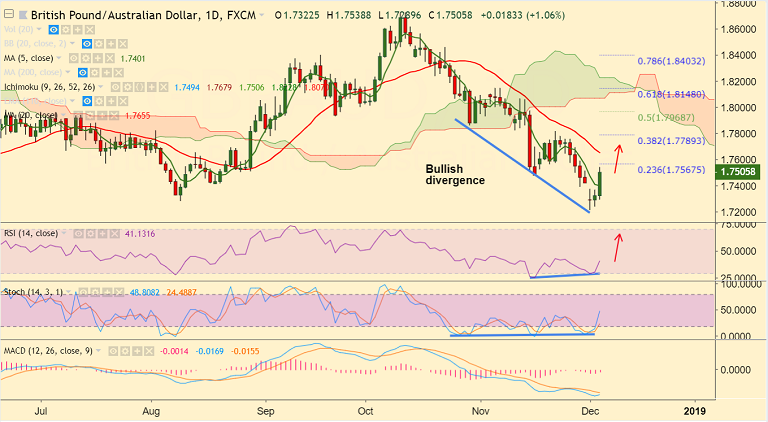

GBP/AUD chart on Trading View used for analysis

- GBP/AUD spikes higher on the day supported by positive Brexit news and dismal Australia GDP.

- The pair is trading 1.12% higher on the at 1.7517, breaks above 5-DMA.

- Downside was snapped with a Doji formation on Monday's trade.

- We also evidence bullish divergence on RSI and Stochs which keeps scope for further upside.

- Next bull target lies at 23.6% Fib at 1.7567 ahead of 20-DMA at 1.7655. Break above 20-DMA could see test of 200-DMA.

- On the flipside, retrace below 5-DMA could see resumption of weakness.

Support levels - 1.7401 (5-DMA), 1.7235 (lower BB), 1.7208 (Dec 3rd low)

Resistance levels - 1.7567 (23.6% Fib), 1.7655 (20-DMA), 1.7789 (38.2% Fib)

For details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data