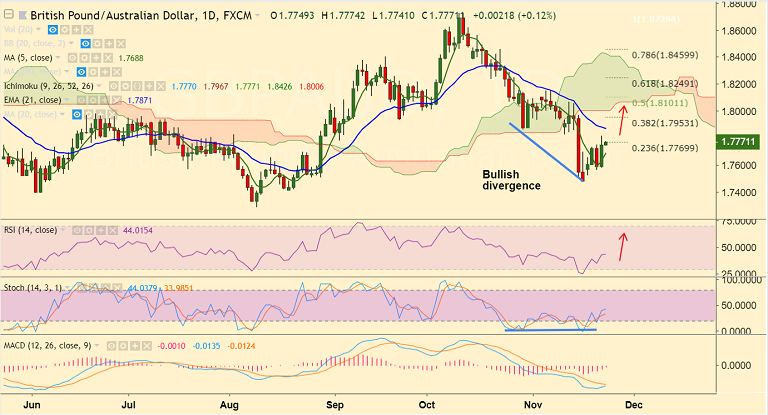

GBP/AUD chart on Trading View used for analysis

- GBP/AUD consolidates previous session's gains, bias higher.

- The pair has tested 23.6% Fib retracement at 1.7770 and bullish divergence keeps scope for further upside.

- Stochs and RSI are showing a rollover from oversold levels and MACD is also on verge of a bullish crossover.

- Next major resistance aligns at 21-EMA at 1.7869. Break above targets 38.2% Fib at 1.7953.

- We see immediate support at 5-DMA at 1.7685. Break below 1.7485 (trendline support) to see major weakness.

Support levels - 1.7685 (5-DMA), 1.76, 1.7474 (Nov 16 low)

Resistance levels - 1.7869 (21-EMA), 1.7953 (38.2% Fib)

For details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data