Ever since we saw whipsaws pattern, the current prices jump consistently above DMAs with bullish crossover after whipsaws to hit fresh 8-weeks highs of 148.459 levels. For now, more rallies are likely to drag further but momentum has been shrunk away.

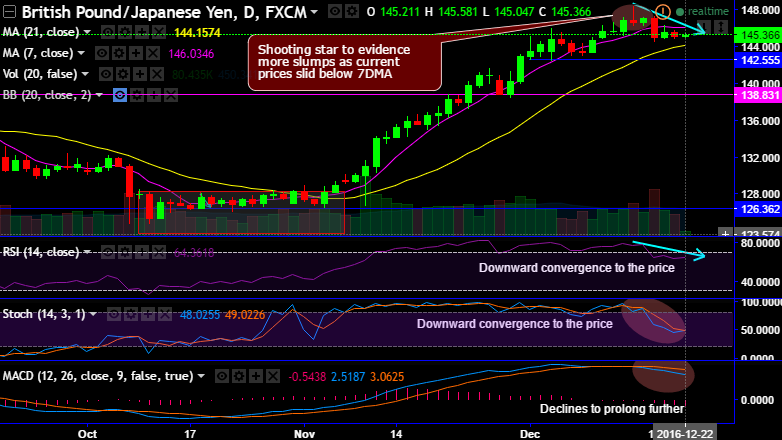

7-weeks uptrend now seems edgy as the shooting star has been traced out at 146.698 levels on the daily chart.

This bearish pattern has occurred at peaks of uptrend to evidence more slumps as current prices slid below 7DMA.

Both RSI and stochastics oscillators have been converging downwards to the price declines. While MACD signals the prevailing price declines to prolong further.

The story appears to be a bit puzzling if you have to plot weekly chart.

The bears in major trend have been giving space to bulls (see weekly chart), it seems like a bottoming out at supports of 126.277 levels to bounce back above 7EMA on weekly terms.

More rallies likely upon bullish SMA crossover with momentum confirmed by positive convergence by leading and lagging indicators.

Both RSI and stochastic to substantiate the bullish sentiments by its healthy convergence on weekly terms.

Well, in general, the bearish effects in short term are on the table while the extension of bull swings can also not to be disregarded in medium terms.

Trade tips:

On an intraday trade perspective, contemplating the above technical reasoning as the momentum in downswings is intensified; we could see the trading opportunities in tunnel spreads that are binary versions of debit put spreads.

Upper strikes – 146.0390, downward strikes – 144.894.

This strategy seems best suitable on intraday speculative grounds for certain yields but with leveraging effects. But in long run, one has to wait and sit with hedging plans for the better clarity.