Bearish GBPUSD Scenarios:

1) The UK-EU fail to agree on a trade deal and the UK exits the transition period on WTO terms.

2) A renewed economic lockdown in the autumn/winter.

3) UK fiscal deficit extends towards 20% of GDP. 4) The BoE delivers more QE, forward guidance and NIRP.

Bullish GBPUSD Scenarios:

1) Agreement on a relatively expansive UK0-EU FTA.

2) A rapid post COVID-19 economic recovery.

3) The government extends the furlough scheme into 2021.

Projections For GBP:

GBP has been one of the strongest performing currencies in the past month. It has rallied partly on EUR’s coat-tails, but it has also outperformed in an underlying sense, assisted by the BoE’s loss of appetite for negative rates. Although we are observing some upgradation in the projections for cable in sympathy, Brexit is still being overshadowed, this is only momentary and hence, sterling remains jittery from a great sense of realism amongst investors about the government's objectives for the EU trade talks and its credible threat still to walk away in the pursuit of regulatory autonomy from the EU and freedom from strict level playing field commitments. As a result of the Brexit-virus coupled with Covid-pandemic, we are maintaining the GBP downside forecasts.

OTC Outlook & Hedging Strategies:

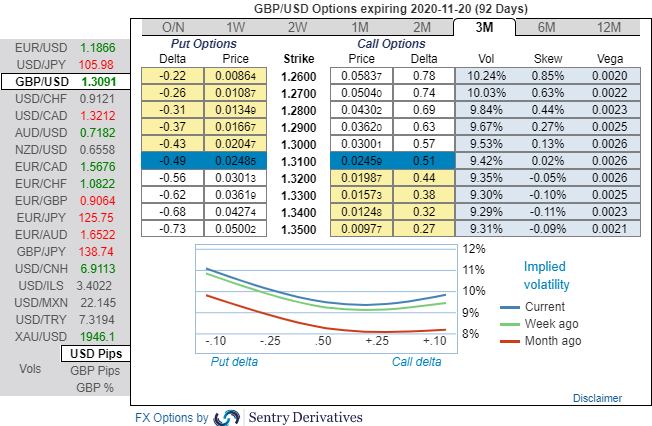

Options Strategy (Debit Put Spread): Contemplating above factors, we think, it is wise to deploy diagonal options strategy by adding short sterling: short a 2M/2W GBPUSD put spread (1.3267/1.28), spot reference: 1.3212 levels.

The Rationale: Observe the 3m GBP’s positive skewness that has still stretched towards OTM Put strikes upto 1.26 levels, to substantiate this bearish hedging stance, existing bearish risk-reversal setup remains intact amid minor bids of hedging for the short-term upside risks.

Hence, options traders are expecting that the underlying spot FX to slide southwards.

Alternatively, on hedging grounds, activated shorts in GBPUSD futures contracts of August’20 deliveries with an objective of arresting potential slumps, we wish to uphold them for now. Courtesy: Sentry, Saxo & JPM

European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data