GBP/USD jumps sharply more than 30 pips after release of UK jobs data. The pair hits high of 1.32282 and is currently trading around 1.32217. UK wage growth inc bonus came at 2.7% fastest pace in 10 years and unemployment rate steady at 4%. Markets eye EU Brexit working dinner tomorrow for further major movement.

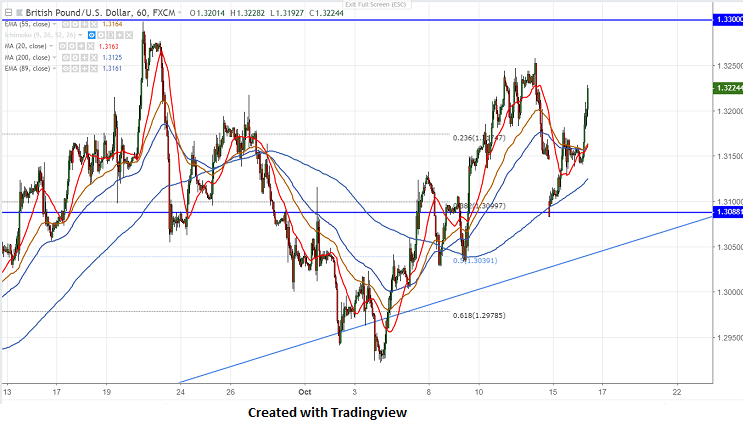

On the higher side, near term resistance is around 1.3215 and any break above targets 1.32578/1.3300. it should break above 1.3300 for further upside.

The near term support is around 1.3160 (55- H EMA) and any convincing break below targets 1.3125 (200- H MA)/1.3080.

It is good to sell on rallies around 1.3275-80 with SL around 1.3300 for the TP of 1.31500/1.30800.