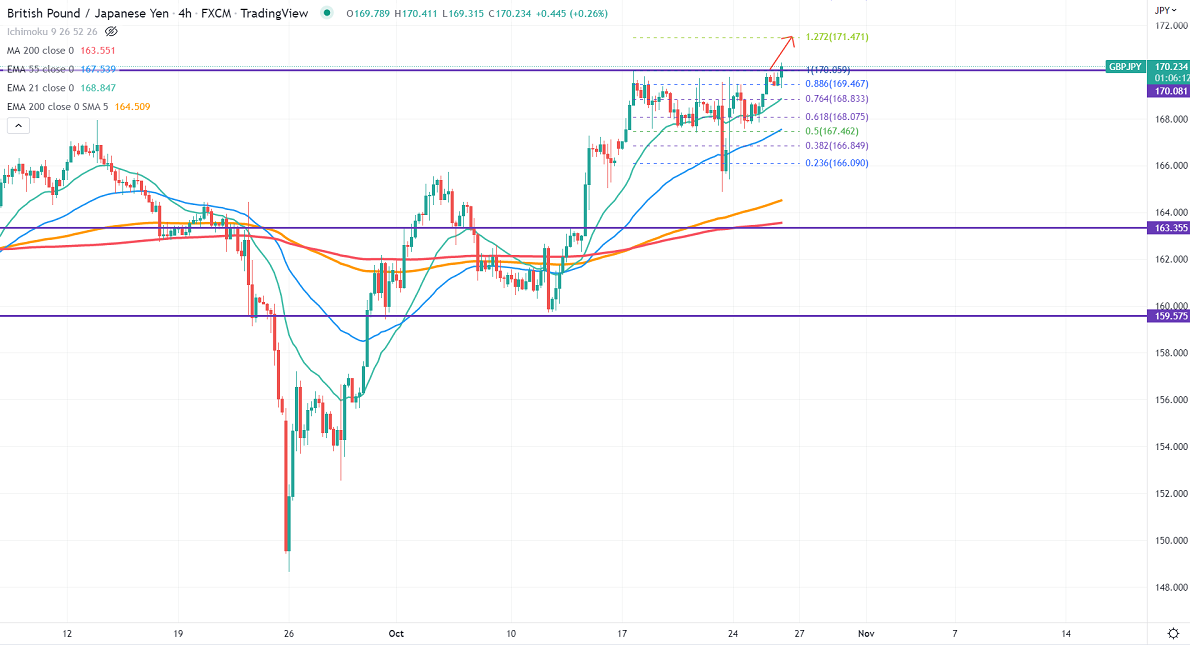

FxWirePro- GBPJPY breaks significant resistance 170, jump to 172 possible

GBPJPY has formed a double top around 170 and has shown a minor decline due to the strong yen. US index S&P showed a minor sell-off after Microsoft trims sales forecast. The increase in risk aversion supports the yen at lower levels. The pound sterling jumped sharply in the UK as the election of a new PM increased political stability. Market eyes new UK fiscal plans for further direction. Any close above 1.1550 confirms further bullishness, a jump to 1.1745 is possible. Technically in the 4-hour chart, GBPJPY holds above short-term 21-EMA, 55- EMA, and long-term 200 EMA (164.45). Any convincing close above 170 will take the pair to the next level 172/175. GBPJPY hits an intraday low of 169.32 and is currently trading around 168.896.

The near-term support is around 169, a breach below targets 168.25/167.40.

Indicators (4-hour chart)

CCI (50) – Bullish

ADX- bullish

It is good to buy on dips around 170.15-20 with SL around 169.20 for a TP of 172.