GBPUSD recovered sharply nearly 200 pips from low of 1.2695 made on Oct 30th 2018 on account of positive Brexit news. The pair hits high of 1.28835 and is currently trading around 1.28750.

Pound sterling was trading higher against all majors after news came that tentative agreement came between UK and EU on financial services which would give UK companies access to EU.

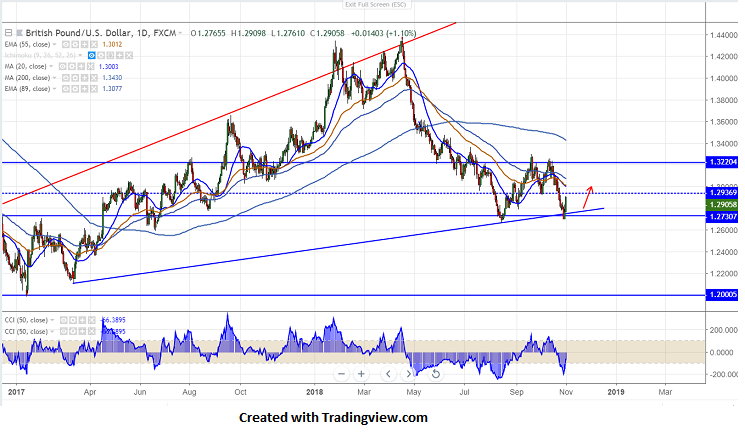

On the lower side, near term major support is around 1.2860 and any break below targets 1.2813/1.2780.Any break below 1.2660 confirms bearish continuation.

The major resistance is around 1.2925 and any violation above will take the pair to next level till 1.3000. The break above 1.3050 confirms minor bullishness.

It is good to buy on dips around 1.2855-60 with SL around 1.2800 for the TP of 1.3000.