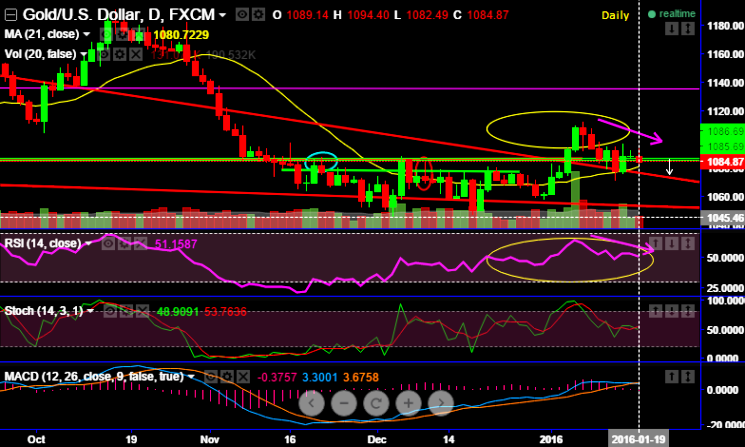

The gold is attempting break support at 1087.40 (yesterday's lows), it seems like all chances of hitting the baseline of descending triangle once again at around 1062.23 to bounce back.

However, the recent price behavior tested the same level of support and we saw the jump all the way upto 1112.89 but from there it has not sustained that breach.

Bulls could not take it forward as 21DMA has acted as a resistance levels We believe, often and often we see bears trimming golds recent gains.

Today as the day opens 1089, even if it makes an attempt of jump above supports but bears could not resist to hold day highs (1094.40) to push it southwards.

On a long term basis, we can only see buying chances above 1132.17 and still carry bearish view as long as the prices maintain below 1132.17 (61.8% correction), so no surprise if the yellow metal plunges back to 1045.36 and then slipping towards 78.6% fibo targets.

While on daily terms, RSI is converging to the price dips (Currently, trending around 51.7795 while articulating), so this indicator justifies potential price dips.

Although there is neither convincing bearish nor bullish crossovers on slow stochastic, but current price actions seem like it is attempting to slip below 21DMA levels which is a signal to drag ongoing bearish trend.

Hence, contemplating above technical indications, on medium term basis it is advisable to short rallies for targets of 1078 and upon breach of these level 1048.10 levels can also be upheld with strict stop loss of 1094.10 and 1132.17 levels.

FxWirePro: Gold likely to retest support at baseline of descending triangle – Short for TP1 at 1078 and TP2 at 1062.23

Tuesday, January 19, 2016 3:07 PM UTC

Editor's Picks

- Market Data

Most Popular