Gold hits low of $1196 and shown a minor recovery on slight dollar profit booking and decline in US 10 year yield.

The major three factors that drive gold prices

US dollar Index: Neutral for intraday. DXY has declined more than 70 pips and taken support near 5 day MA. It is currently trading around 97.14.The near term resistance is around 97.70 and any break above targets 98. ( neutral for gold).

USD/JPY: strong . The pair is consolidating after hitting high of 114.22.USDJPY has jumped more than 350 pips from low of 111.37 and hits 5-week high at 114.22. It is currently trading around 113.90. The near term resistance is around 114.25 and any break above targets 114.55/115. Slightly negative for gold.

US 10 year yield : US 10 year yield has lost more than 3.5% from high of 3.25%.Any further bullishness only above 3.25%. It is currently trading around 3.14%. Slightly positive for Gold.

US 2 year yield: It is trading lower after hitting hitting fresh multi-year high at 2.98%.The spread between US 10 year and 2 year has decreased from 30bpbs to 24bpbs.

Gold technical

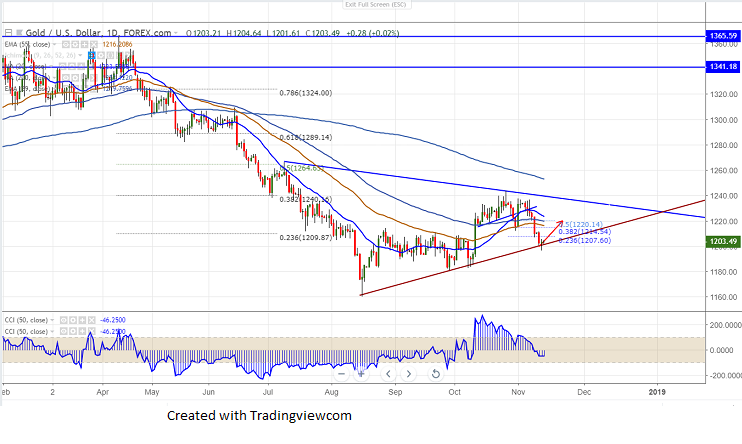

Major support $1183

Major resistance - $1240

The yellow metal shown a dead cat bounce after showing a minor decline below trend line. On the higher side, major resistance is around $1207 (23.6% fib) and any break above $1207 will take the commodity till $1216.50/$1227/$1236 .It should break above $1243 (Oct 26th 2018 high) for bullish continuation.

The near term support is around $1190 and any violation below will drag the commodity down till $1178/$1160..

It is good to buy on dips around $1200 with SL around $1190 for the TP of $1220.