The major three factors that drive gold prices

US dollar Index: Bullish. DXY has closed above trend line resistance at 95.95 yesterday. The index hits high of 96.16 and is trading around 95.95. The near term intraday trend reversal level is around 96.16 and any break above targets 96.32/97. It should break above 97 for further bullishness. ( Slightly negative for gold).

USD/JPY: weak . The pair has taken support near 112 and shown a minor jump from that level. Any further weakness cane be seen below 111.50. The near term resistance is around 113 and any break above targets 113.48/114. Slightly positive for gold.

US 10 year yield : US 10 year yield is trading muted after hitting high of 3.25%. It was trading in narrow range between 3.25% and 3.128% for past 10 working days.It is currently trading around 3.17%. Slightly Negative for Gold.

US 2 year yield: It is trading slightly lower after hitting fresh high at 2.925% .The spread between US 10 year and 2 year has increased from 22bpbs to 28bpbs.

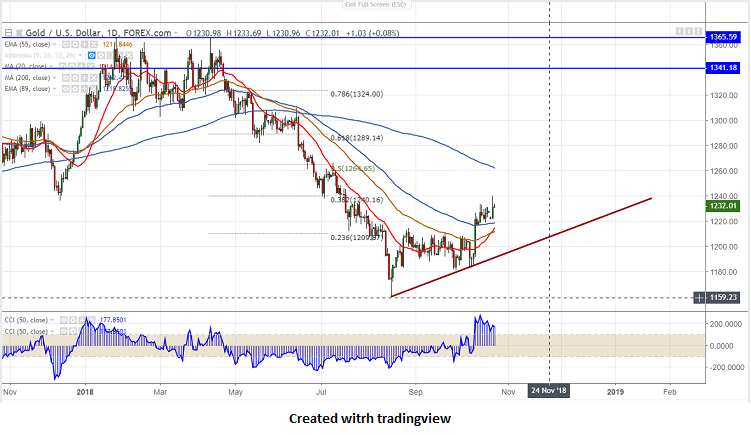

Gold technical

Major support $1183

Major resistance - $1217

The yellow metal has recovered more than $15 from low of $1222 on account of weak global stock market .On the higher side, any break above $1240 will take the commodity till $1265 .It should close above $1265 for bullish continuation.

The near term support is around $1218 (89- day EMA) and any violation below will drag the commodity down till $1211/$1204.

It is good to buy on dips around $1227-28 with SL around $1218 for the TP of $1250/$1265.