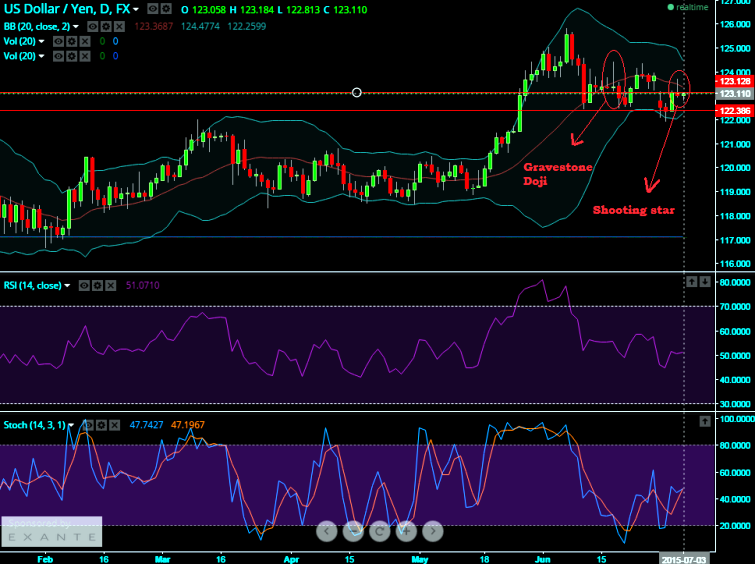

For today, technical charts suggest little sideways to upward but certainly the indication of weakness in this pair on EOD charts as an attempt of filling up of gap down that we had traced out with a spinning top candle pattern two days ago and more evidently these price patterns have been substantiated with abundant volumes.

And in addition we believe it has been testing support at 123.12 levels if it manages to break these levels then we see all chances of dragging towards 122 levels back again.

The Gravestone Doji at 123.410 levels followed by the next candle after doji also falls to the downside is a strong bearish confirmation that the earlier doji's signal of market topping would sustain and in addition to that shooting stars appeared yesterday at 123.016 to substantiate bearish trend to begin. We suspect around 123 levels are some negotiating points for investors.

On intraday day charts oscillating indicators such as RSI (14) and slow stochastic curves are moving in convergence with prevailing upswing price patterns.

RSI on intraday charts currently oscillating at 51.2569 while %K line cross over near 25 levels on slow stochastic which is not that significant for both bulls and bears.

We look at either shorting futures for pair to hit targets of 122.50 1st & then even 122 levels in medium term or buying binary puts at current prices can also be beneficial for the same targets with a strict stop loss at 123.50. Thereby risk reward ratio would be at 0.33.

FxWirePro: Gravestone DOJI and shooting star signal USD/JPY weakness; short futures for target at 122.35

Friday, July 3, 2015 6:35 AM UTC

Editor's Picks

- Market Data

Most Popular