We spot on the pair that has the least ATM IVs when the underlying spot FX has also been drifting in range bounded trend. We upgraded our CHF forecasts.

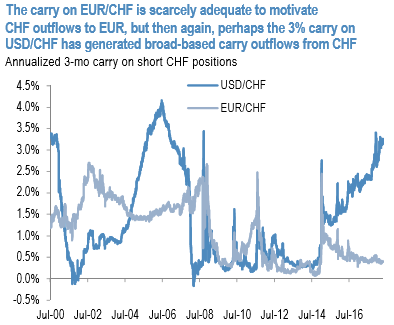

Last month we lowered our forecasts for the franc to take account of a carry trade dynamic that was shaping up to be more powerful than we had anticipated. The pull of interest rate differentials on the franc was evident not so much on EURCHF, where actual and prospective carry is still only 40bp and so seemingly still too low in a historical context to motivate substantial unhedged capital outflows, but rather through USDCHF where carry is of the order of 300bp and hence one of the most attractive carry pairs globally (refer above chart).

There are no additional changes to the EURCHF forecast this month –the cross is now almost exactly in line with its 30Y average real value which seems to us a reasonable level for the franc to consolidate. We are however marking-to-market the USDCHF forecasts. The 2Q forecast is raised from 0.95 to 0.97, the 1Y forecast from 0.92 to 0.94.

Hedge via debit put spreads:

Please be noted that the bearish neutral risk reversals indicate hedging sentiments for the bearish risks remain intact.

Subsequently, we advocate buying USDCHF 3m debit put spreads using strikes 0.9989/0.9732 (at spot ref: 0.9989).

For a net debit, bear put spread reduces the cost of trade by the premium collected (on the shorts of OTM put) and keeps option trader to participate in downward moves and any upswings in abrupt.

Moreover, the risk is capped to the extent of initial premium paid, as opposed to unlimited risk when short selling the underlying outright.

However, put options have a limited lifespan. If the underlying FX price does not move below the strike price before the option expiration date, the put option will expire worthless.

Currency Strength Index: FxWirePro's hourly USD spot index is inching towards 13 levels (which is neutral), while hourly CHF spot index was at a tad below 2 (neutral) while articulating (at 11:44 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex

FxWirePro launches Absolute Return Managed Program. For more details, visit:

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis