Technically, major support is at $17.24/oz, the location of the 200-day moving average, which if broken on a closing basis could endanger the uptrend.

For now, the next roughly year-and-one-half, we believe silver will outperform gold during periods of positive QoQ gold returns and vice versa during periods of negative QoQ gold returns. This equates to a constructive forecast throughout 4Q16 and 1Q17—a quarter in which we forecast prices average $22.04/oz—in line with our view on gold.

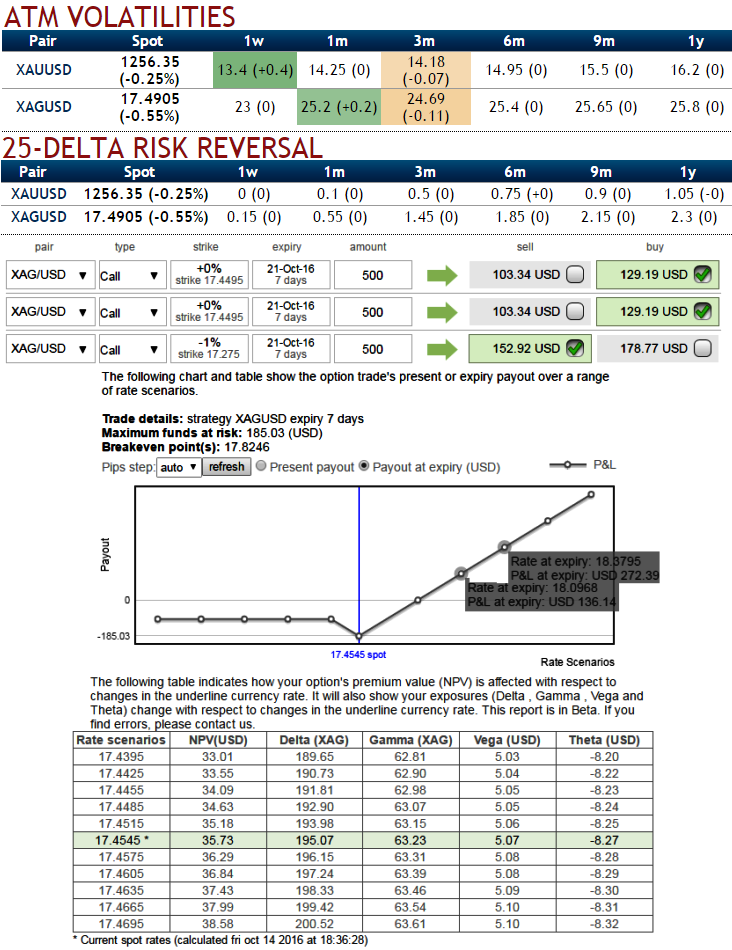

Elsewhere, in OTC bullion markets, ATM IVs of silver contracts of 1-3m expiries are at 25%, while bullish delta risk reversal flashes higher positive numbers that signify OTC bullion is more concerned about upside risks of silver.

If IV is high, it means the market thinks the price has the potential for large movement in either direction.

Option strategy:

As shown in the diagram, hence, we recommend initiating longs in 2 lots of 1M ATM +0.51 delta call, and simultaneously short 1 lot of ITM call (1%) with comparatively shorter expiry (preferably 1w expiry) in the ratio of 2:1.

So, trading option spreads in different strikes allows the bullion traders in hedging upside risks during many tricky market scenarios and likely to fetch positive cashflows as the price keeps ticking up.

The lower strike short calls seems little risky but because IV responds adversely, the likelihood of options expiring in the money is very less and it finances the purchase of the greater number of long calls (ATM calls are reasonably priced, so we loaded up with the weights in the spreads) and the position is entered for reduced cost. Please be noted that the tenors and strikes chosen in the diagram are just for demonstration purpose, use appropriate inputs as stated above.

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure