Signs of Brexit contagion in FX and Rates vol markets are very dim, and we keep our tactical short gamma bias for the upcoming weeks.

This week, the monetary policies of BoE and BoC are in the focus, China data deluge, US earnings, flash PMIs are the major key data areas, while next ECB is scheduled in the week for its monetary policy announcements.

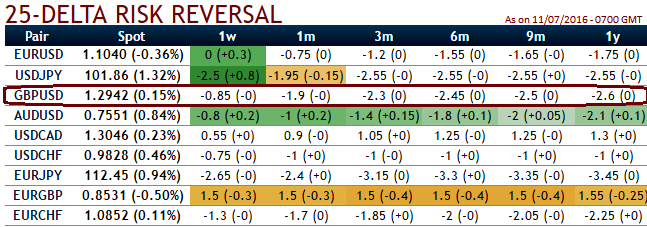

We continue to play the long-ball game – nothing fancy, just concentrating on the highest conviction view (bearish GBP). Since GBPUSD negative delta risk reversals are increased for further downside risks in next 3m to 1y tenors which is still second highest among the G10 currency segment, we increased a short GBP basket on Monday, adding EUR to existing cash positions in USD, JPY, and RUB.

We realise almost maximum returns on the various cable short positions such as put spreads. Brexit has proved highly contagious for bond markets, and supportive for a barbell of both high- and low-yielders. It doesn’t seem that the US jobs report was sufficiently emphatic to reverse this process.

Either way, we are largely hedged on risk market direction with RUB longs offsetting legacy option shorts in AUD.

Trade Recommendations For Other Currency Crosses:

Inverted vol curves in USD/JPY and JPY crosses have made calendar spreads of JPY One-Touch calls a standout strategy this year.

Short gamma positions in EUR crosses are an efficient way to sponsor longs in forward vols in anticipation of a potentially bumpy Q4.

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?