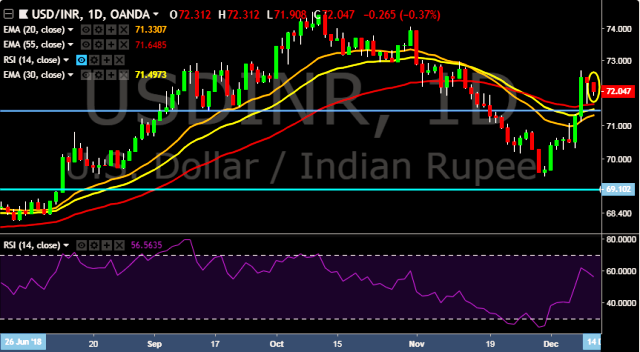

- USD/INR is currently trading around 72.03 marks.

- It made intraday high at 72.31 and low at 71.90 marks.

- Intraday bias remains slightly bearish for the moment.

- Key resistances are seen at 72.47,72.86, 73.27 and 73.70 marks respectively.

- On the other side, initial supports are seen at 71.87, 71.12, 70.57, 70.27, 69.87, 69.66, 69.34, 69.02, 68.65 and 68.15 marks respectively.

- Important to note here that 20D, 30D and 55D EMA heads down and confirms the bearish trend in a daily chart.

- India’s NSE Nifty was trading around 1.12 percent lower at 10,373.58 points while BSE Sensex was trading 1.20 points lower at 34,567.55 points.

- India will release economic data around 1200 GMT.

We prefer to take long position on USD/INR around 72.00, stop loss at 71.87 and target of 72.47.