The Turkish lira rallied strongly in the past two sessions as media speculation mounted that CBT will finalise $20bn of swap lines from the BoJ and BoE. Such swap lines make a secondary story. They would not have really turned around the lira’s prospects in an adverse fundamental environment, even if the Fed and ECB had joined with the other two (they have not).

Nevertheless, right now the signs are positive for a quick rebound of Turkish exports as the EU is preparing to return to activity. An expectation of stronger export numbers immediately, we think, will dispel the lira’s current woes, although many problems will remain in the longer-term.

We have been UW in the GBI-EM Model portfolio since April 2nd. This reflects our view that currencies with large external debt repayment needs as well as countries that rely on tourism are likely to underperform. Overall, the BoP dynamic will be crucial for lira's performance, in our view.

The current account recorded a likely temporary $4.9bn deficit in March. On a seasonally adjusted basis this was worth about $3.9bn and in annualized terms 6.6% of GDP. There is very likely a strong temporary component to this result, with earlier lockdowns in Europe affecting exports before measures in Turkey constrained domestic demand. For the year, our economist expects close to a flat position on the current account, but there are large uncertainties in the current environment.

Hedging Strategy:

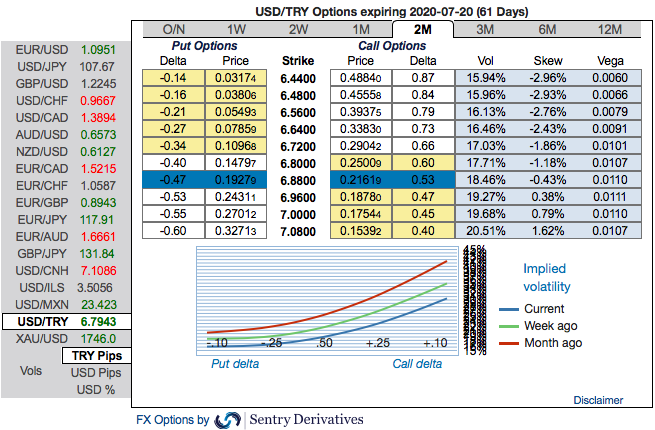

On hedging grounds, capitalizing on prevailing price dips and above driving forces, we already advocated 2m USDTRY debit call spreads with a view to arresting momentary downside risks and upside risks in the major trend. At spot reference: 6.7940 level, initiated 2m 6.25/7.20 call spreads at net debit. One can achieve hedging objective as the deep in the money call option with a very strong delta will move in tandem with the underlying spikes.

It seems that hedgers of TRY are positioned for the upside risks on the above fundamental factors. The skewness 2m IVs are indicating upside risks, higher bids for OTM calls are hedging bias towards upside risks (refer above nutshell).

IVs of this underlying pair is also on the higher side, trending highest among the G20 FX space. Call options with a higher IVs cost more, because, increasing IV is conducive for the option holder, just for an intuition that the higher likelihood of the market ‘swinging’ in holder’s favour. Courtesy: Sentry, JPM & Commerzbank

Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge