The acceleration in global growth towards 3% might even cause us to entertain the notion of adding some outright longs in cyclical currencies. What prevents us doing so is the caveat that these are not normal times politically speaking; in particular, we continue to believe that markets are overly complacent about the possibility of the President-elect acting on campaign pledges to address what it believes are unfair trade practices.

The Outlook discusses this issue in more detail, but the likelihood is that any action on trade following the inauguration would not sit easily with either risk markets or cyclical currencies.

Well, in our 2017 outlook, we included a number of protectionist hedges in G10 commodity currencies and we remain comfortable with both of these positions even though they are marginally in the red (short CAD/NOK in cash and short AUD/JPY through a 3Mx6M calendar spread of one-touch puts).

Stay long NOK vs EUR and CAD We continue to recommend NOK longs as an outright play on stronger oil prices and the ongoing improvement in the outlook for NOK rates (EUR/NOK) as well as an oil-neutral hedge to potential trade conflict under the incoming Trump Administration (CAD/NOK).

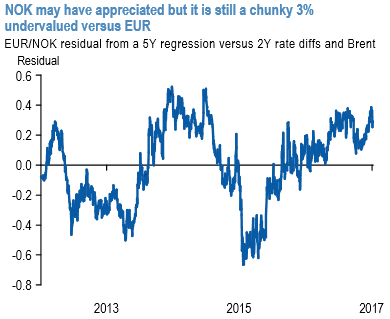

NOK is the second strongest performer in G10 since the last FXMWon December 16 (up 2.2% versus USD) yet it has plenty of headroom still to rally as it remains markedly undervalued relative to cyclical drivers.

Fair-value for EUR/NOK currently stands at 8.72; the resultant 3% undervaluation of NOK is amongst the more extreme of the last five years (this is a 1-sigma gap – refer above chart).

In addition, NOK TWI is 1.7% lower than the Norges Bank projects for Q1; hence there’s no suggestion the currency is close to levels that could start to undermine the interest rate outlook.

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts