CAD investors are torn between two opposing scenarios: on the one hand the Canadian economy has overcome the collapse of the oil price in 2014/2015 and is recording decent growth rates once again, and as a result signals towards a normalization of monetary policy are emerging from amongst members of the Canadian central bank (Bank of Canada, BoC).

On the other hand, the renewed downtrends in the oil price, as well as the protectionist approach on the part of the US administration, entail new economic risks. The US administration announced only yesterday that it would introduce anti-dumping duties on timber imports from Canada thus escalating a trade dispute with its neighbor that had been simmering since November.

Investors are likely to now be waiting for an indication from BoC governor Stephen Poloz and vice governor Lynn Patterson, who are both taking part in an ECB forum in Portugal, on the BoC’s future approach over the coming days. Should both continue to sound optimistic – despite the above risks – CAD will be able to make further ground against USD.

OTC Outlook and Options Strategy (USDCAD):

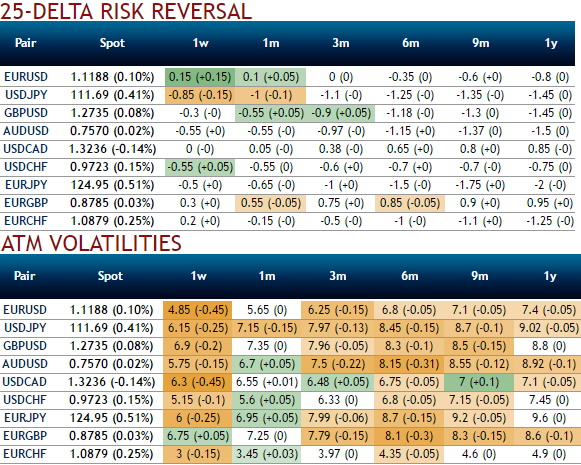

Please be noted that the above nutshell showing IVs and risk reversals of this pair, that has been neutral. Implied volatilities have been extremely lower among the G7 FX space and you could also make out that there have been no hedging sentiments (neutral risk reversals in 1w tenors and with bullish neutral hedging sentiments in 1m-1y tenors).

Well, contemplating these OTC indications, using collar spread options strategy, the investor gets to earn a premium on writing overpriced calls, simultaneously add a protective at the money put option. Appreciate all benefits of underlying spot outrights moderately. If he’s having FX payables unless he is assigned an exercise notice on the written call and is obligated to sell his spot outright holdings, this strategy is a risky venture.

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?