Refer NZD/CAD chart on Trading View

- NZD/CAD extends gains for a 3rd straight session, intraday bias higher.

- The pair is trading 0.17% higher at 0.8677 at the time of writing.

- Kiwi was buoyed after upbeat New Zealand PPI data released earlier today.

- The New Zealand PPI figures clocked in better than expected, coming in at 1.0% versus the previous period's 0.6%.

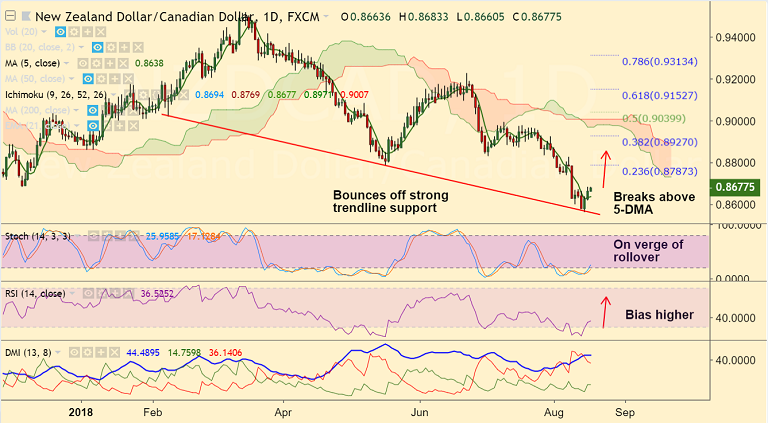

- Price action has broken above 1H 200-SMA raising scope for further upside.

- Next major resistance lies at 21-EMA at 0.8755 ahead of 23.6% Fib at 0.8787.

- On the flipside, 5-DMA is immediate support, break below will see weakness till trendline support at 0.8560.

Support levels - 0.8638 (5-DMA), 0.86, 0.8560 (trendline)

Resistance levels - 0.87, 0.8756 (21-EMA), 0.8787 (23.6% Fib)

FxWirePro Currency Strength Index: FxWirePro's Hourly NZD Spot Index was at 114.09 (Bullish), while Hourly CAD Spot Index was at -97.2306 (Bearish) at 0935 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.