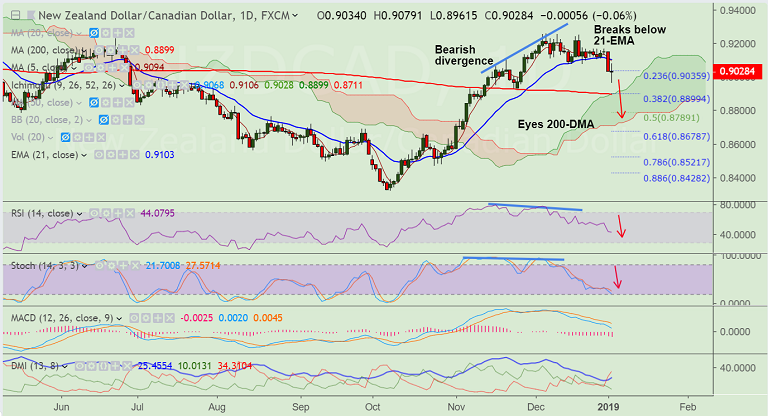

NZD/CAD chart on Trading View used for analysis

- NZD/CAD extends previous session's slump, intraday bias bearish.

- The pair hit 4-week lows at 0.8961 before paring some losses to currently trade at 0.9015.

- Price action has slipped below 21-EMA support raising scope for further weakness.

- Bearish divergence on RSI and Stochs along with -ve DMI dominance adds to the bearish bias.

- Next bear target lies at 200-DMA at 0.89. Violation there will see dip till 61.8% Fib at 0.8678.

- On the flipside, retrace above 21-EMA could see some consolidation.

Support levels - 0.89 (converged 200-DMA and 38.2% Fib), 0.8789 (50% Fib), 0.8678 (61.8% Fib)

Resistance levels - 0.9101 (21-EMA), 0.92, 0.9256 (Dec high)

Recommendation: Good to go short on upticks. SL: 0.91, TP: 0.89/ 0.8790/ 0.8680