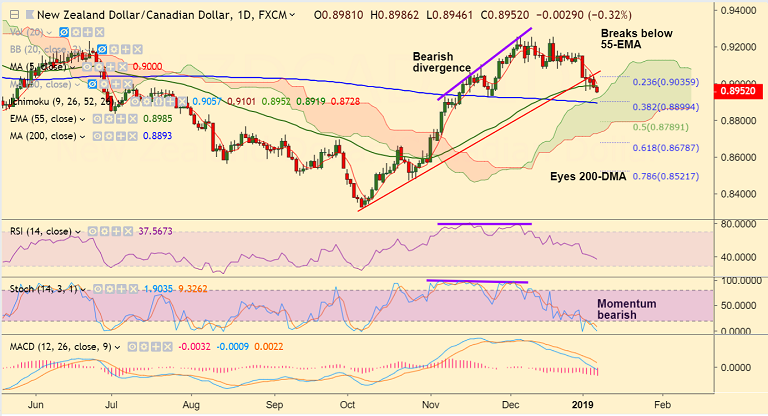

NZD/CAD chart on Trading View used for analysis

- NZD/CAD grinds lower for the 3rd straight week, bias remains bearsih.

- Momentum with the bears. RSI is below 50 and biased lower. MACD supports weakness.

- The pair has broken below 55-EMA support and is on track to test 200-DMA at 0.8893.

- Violation at 200-DMA will see further weakness. Next major bear target lies at 50% Fib at 0.8789.

- 55-EMA is immediate resistance at 0.8985. Breakout at 200W SMA at 0.9070 could see further upside.

- Focus will be on the Bank of Canada (BOC) rate decision (due Wednesday) for further impetus.

Support levels - 0.8919 (cloud top), 0.8893 (200-DMA), 0.8789 (50% Fib)

Resistance levels - 0.8985 (55-EMA), 0.90 (5-DMA), 0.9035 (23.6% Fib)

Recommendation: Good to stay short on upticks, SL: 0.90, TP: 0.8920/ 0.8895

For details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.