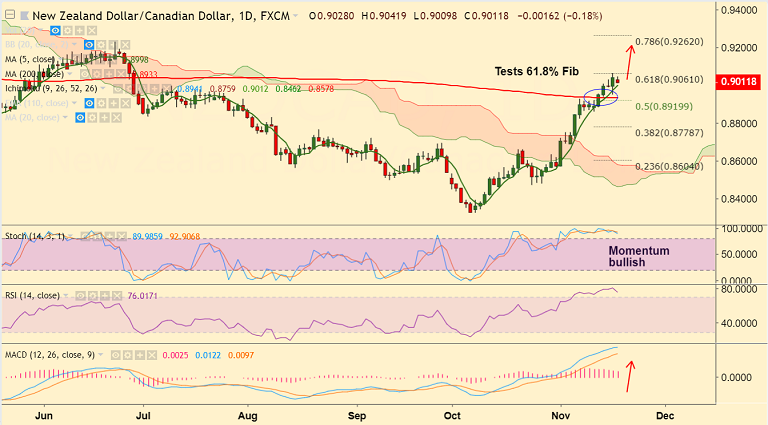

NZD/CAD chart on Trading View used for analysis

- NZD/CAD is trading 0.32% lower on the day after opening with a bearish gap.

- The pair has retraced from 5-month highs of 0.9061 hit on Friday's trade.

- Sharp decline in energy prices and sudden doubts about the passage of the revised NAFTA deal through a Democrat led Congress are weighing on the Canadian dollar.

- Breakout above 200-DMA has raised scope for further upside. Momentum studies are bullish.

- 200W SMA at 0.9078 is next major resistance above 61.8% Fib. We see scope for further upside on break above.

- On the flipside, retrace below 200-DMA will negate bullish bias.

Support levels - 0.8998 (5-DMA), 0.8933 (200-DMA)

Resistance levels - 0.9061 (61.8% Fib), 0.9078 (200W SMA)

Recommendation: Watch out for break above 200W SMA to go long, target 0.9225/ 0.9262

For details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close