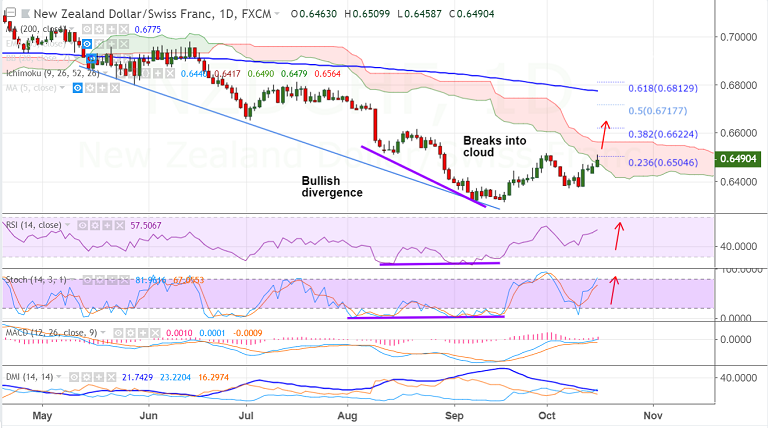

NZD/CHF chart on Trading View used for analysis

- NZD/CHF extends break above 55-EMA, trades 0.17% higher on the day.

- Intraday bias for the pair is bullish. Technical analysis supports further upside in the pair.

- The pair is now in the green for the 5th straight session, edges above 23.6% Fib.

- RSI is above 50 and biased higher, while Stochs also show bullish momentum.

- Price has broken into daily cloud and next major bull target above cloud lies at 38.2% Fib at 0.6622.

- On the flip side, retrace and close below 55-EMA negates bullish bias, scope then for test of 0.6325 (trendline).

Support levels - 0.65 (55-EMA), 0.6481 (5-DMA), 0.6448 (21-EMA), 0.6371 (Oct 8 low)

Resistance levels - 0.6564 (cloud top), 0.6622 (38.2% Fib)

For details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.