- NZD/USD is trading 0.11% higher on the day at 0.6828 at the time of writing.

- We expect the pair to continue choppy trade as we head into the Fed policy meet.

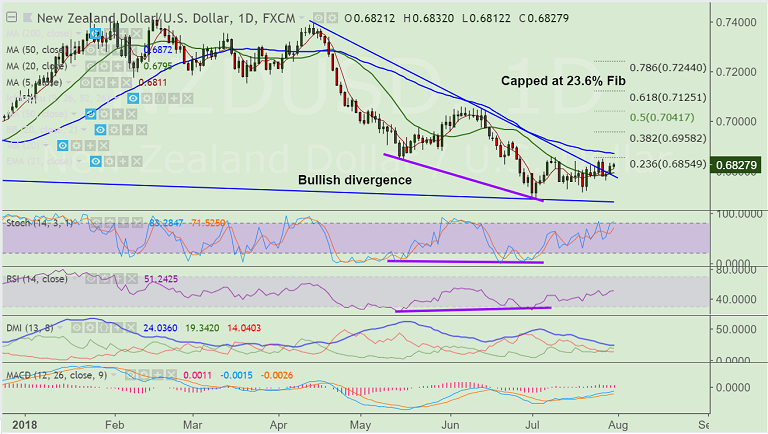

- Technical indicators on daily charts are turning bullish. Stochs and RSI are biased higher.

- We also evidence bullish divergence on RSI and Stochs which keeps scope for upside in the pair.

- Upside finds immediate resistance at 23.6% Fib at 0.6854 ahead of 50-DMA at 0.6880.

- We see continuation of upside only on decisive break above 50-DMA. Scope then for test of 38.2% Fib at 0.6858.

Support levels - 0.6812 (5-DMA), 0.6795 (20-DMA), 0.6713 (July 19 low), 0.6680 (trendline)

Resistance levels - 0.6855 (23.6% Fib), 0.6872 (50-DMA), 0.69

FxWirePro Currency Strength Index: FxWirePro's Hourly NZD Spot Index was at 48.3134 (Neutral), while Hourly USD Spot Index was at -66.0655 (Neutral) at 0515 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.