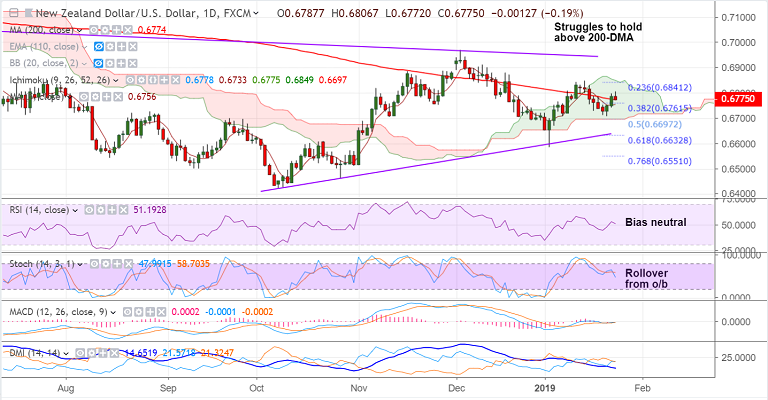

NZD/USD chart on Trading View used for analysis

- NZD/USD retraces from 6-day highs at 1.68 mark, trades 0.16% lower at 1.6777 at 0600 GMT.

- Price action hovers around 200-DMA and close below will negate any bulish bias.

- RSI on daily charts is neutral, but Stochs are showing a rollover from overbought levels.

- 21-EMA is strong support at 0.6767, break below will confirm weakness.

- Break below 21-EMA will take the pair lower till cloud base at 0.6697.

- On the flipside, decisive breakout at 200-DMA will see further gains. Test of 0.6843 (Upper BB) then likely.

Support levels - 0.6774 (200-DMA), 0.6767 (21-EMA), 0.6757 (5-DMA)

Resistance levels - 0.6843 (Upper BB), 0.6883 (Nov 16 high), 0.69

For details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.