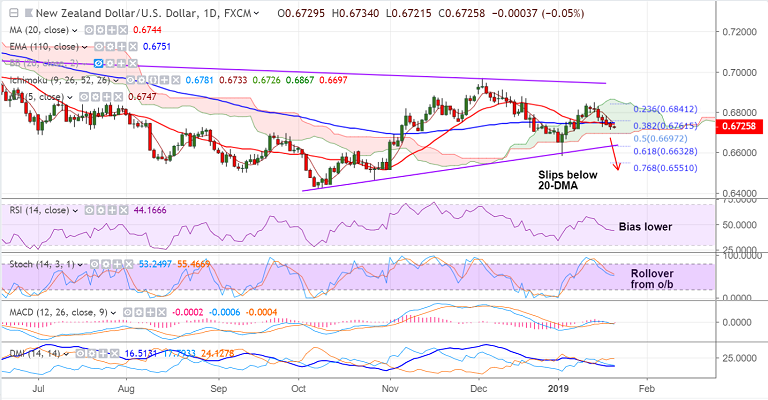

NZD/USD chart on Trading View used for analysis

- NZD/USD trades 0.06% lower on the day at 0.6724 at 0430 GMT, bias bearish.

- The pair has been extending weakness for the 2nd straight week.

- Focus on quarterly inflation numbers for Q4 due Wednesday. The kiwi could face further challenges next week if quarterly inflation numbers disappoint.

- Consensus expectation is for annual inflatiob to have eased from 1.9% to 1.8% in the fourth quarter.

- Any miss on forecasts could worry policymakers and push up the odds that the next move in rates would be down.

- Technical bias remains bearish, price action below major moving averages, 5-DMA is sharply lower.

- Pair eyes cloud base support at 0.6697. Violation there will see drag till trendline support at 0.6640.

Support levels - 0.6697 (cloud base), 0.6640 (trendline), 0.66

Resistance levels - 0.6751 (110-EMA), 0.6761 (38.2% Fib), 0.68

For details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.