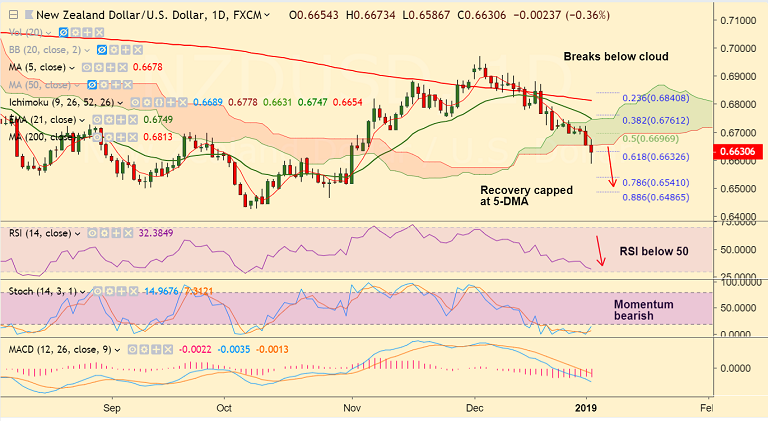

NZD/USD chart on Trading View used for analysis

- NZD/USD trades 0.32% lower at 0.6632 at the time of writing, short-term bearish pressure intact.

- The pair has ignored upbeat GDT auctions data and has resumed weakness after brief bounce.

- Price action has slipped below daily cloud and we see scope for further weakness.

- RSI is well below 50 levels and biased lower and Stochs are heavily bearish.

- The pair is trading below major moving averages and we see rise in volatility.

- Next major support below 61.8% Fib lies at 78.6% Fib at 0.6541. Breach there could see dip till 0.6520 (Oct 26 low).

- 21-EMA at 0.6750 is strong resistance. Bearish invalidation only above 200-DMA.

Support levels - 0.66, 0.6541 (78.6% Fib), 0.65

Resistance levels - 0.6679 (5-DMA), 0.6750 (21-EMA), 0.6813 (200-DMA)

Recommendation: Good to go short on upticks, SL: 0.6680, TP: 0.66/ 0.6540/ 0.65