Asian markets are trading higher especially Nikkei is trading near 1-1/2 week high on dovish Fed monetary policy. Fed has kept its interest rates unchanged and pledges pledges ‘patience’ stance on further moves.It also stated that they are ready to alter balance sheet if needed.US markets has closed higher especially Dow Jones above 25000 for first time since Dec 2018 25014 (1.77% higher) and S&P500 2681 (1.55% higher).Chinese Shanghai composite is trading slightly higher and is currently trading around 2591.84 (0.63% higher). USDJPY is trading lower and lost nearly 100 pips from yesterday’s high of 109.74. The near term support is around 108.50 and any break below targets 108/170.50.It is currently trading around 108.87.

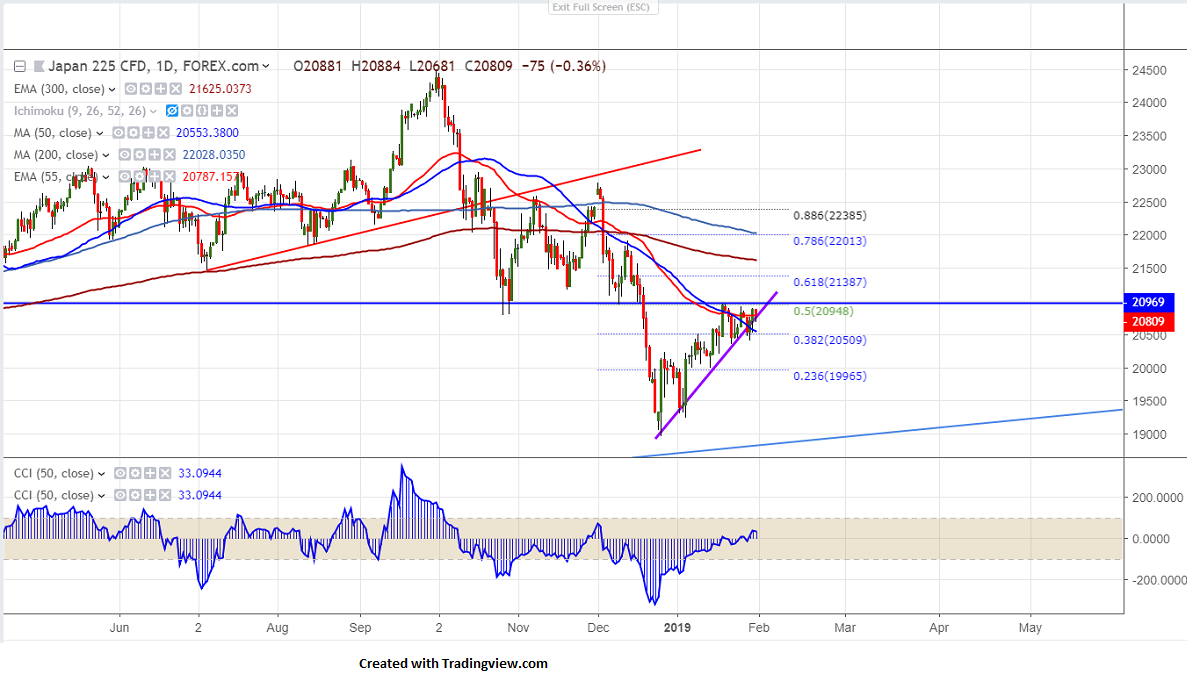

On the lower side, near term support is around 20500 and any break below targets 20200/20000.

The near term resistance is at 21000 and any break above targets 21387/21573.

It is good to buy on dips around 20680-700 with SL around 20480 for the TP of 21200/21387.