Asian markets is trading extremely weak following footsteps of Wall Street. US market was trading extremely lower and has lost more than 3% on yield curve inversion. The 3 year yield curve has surpassed 5 year yield for first time in 10 year which minor weakness in US economy. US futures has shown a minor recovery with Dow Jones at 25117 (0.34% higher) and S&P500 2713 (0.45% higher).Shanghai is trading slightly lower and is currently trading around 2660 (0.24% lower).Nikkei is showing a minor recovery after a 100 point fall and is currently trading around 21889 (0.80% higher) and is currently trading around 21899.

USDJPY is trading lower and lost more than 100 pips from yesterday’s high of 113.66.It is currently trading around 112.95.The near term major support is around 112.40 and any break below targets 112/111.37.

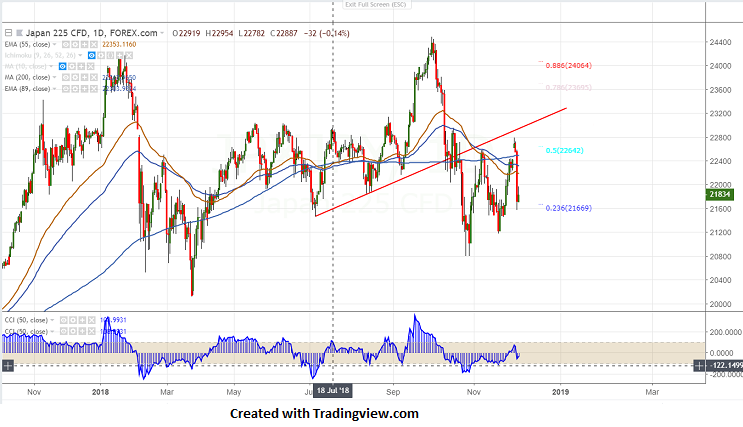

On the lower side, near term support is around 21400 and any break below targets 21174/20795.

The near term resistance is at 22000 and any break above targets 22330/22490 (200- day MA).

It is good to buy on dips around 21550-600 with SL around 21400 for the TP of 22490.