PLN: Cutting the retirement age is a populist measure, which goes against the grain of what most of Europe has had to embrace since the debt crisis - but, a measure with wide public support in Poland. This was one of the policies, besides a bank tax and forced FX loan conversion, which caused risk spreads to widen out sharply and the zloty to sell-off after PiS came to power.

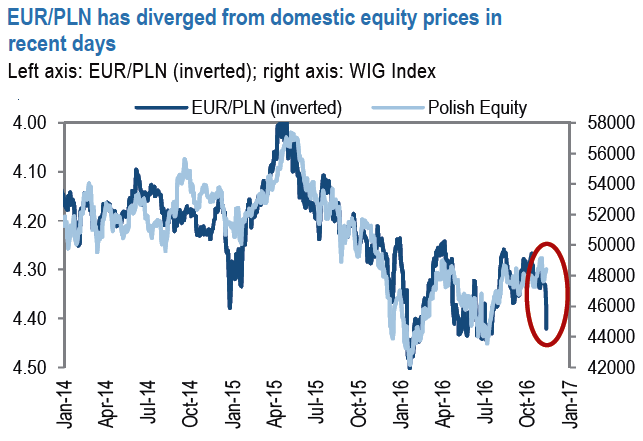

We are neutral PLN but note that EURPLN has strongly diverged from domestic equity prices in recent days (see above chart).

Previous misalignments have always corrected, typically by FX correcting, but with the upward shock now in rates, we think the path could be bumpy especially if there is any real money selling.

CZK: As the CNB nears the exit from its floor policy, the discussion of where EURCZK should settle after the floor becomes highly relevant. The fair value is likely to guide where the currency will gravitate in the medium-term after the exit.

As long as the CNB defends undervalued levels, the appreciation pressure on the currency is likely to persist, in our view.

As a result, we remain bullish the Czech currency, and encourage shorts EURCZK via 27-Nov-17 forwards, targeting 26.0.

The estimates stand at the CZK is currently 5-9% undervalued vs. EUR, with a fair value between 24.7 and 26.0. Initiate shorts in 27-Nov-17 EURCZK forward.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?