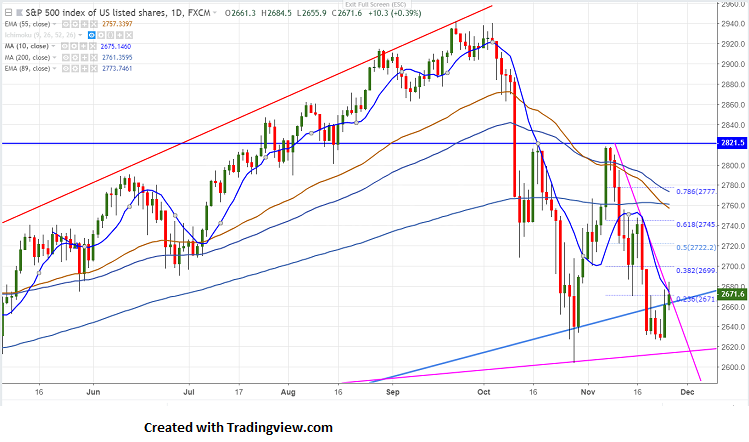

S&P500 is trading higher for second consecutive day and jumped more than 50 points from the low of 2626. The index has lost more than 100 points in previous week after hitting high of 2747. It is currently trading around 2671.8. The index dip was mainly led by energy due to huge selling in crude oil prices.

On the higher side, near term resistance is around 2680 (10- day MA) and any break above targets 2700/2722. The index should break above 2761 (200- day MA) for further bullishness.

The near term support is around 2600 and any violation below targets 2551/2529 level

It is good to buy on dips around 2645-50 with SL around 2625 for the TP of 2715/2747.